Scandalous details have emerged regarding a $600 million fraud lawsuit filed by one of Russia’s largest banks, Moscreditbank, against Mostrade Danışmanlık Ltd., a company registered in Turkey.

According to information received by the Turkish publication Yeni Çağ Qazetesi, Mustafa Yigit Zeren, the head of the Zeren Holding group of companies, abused the trust placed in him and transferred $600 million, which was received from the sale of Russian oil to India through Mostrade Danışmanlık Ltd., to his bank account in Dubai.

Mustafa Zeren then transferred this amount to the accounts of people close to him and, having effectively emptied the bank account of Mostrade Danışmanlık Ltd., severed all ties with the Russian bank that financed the oil sale operation, as well as with the seller company.

As a result, Moscreditbank filed a lawsuit with the Istanbul Public Prosecutor’s Office through its Hong Kong-registered subsidiary Akida Trading Ltd. against Mostrade Danışmanlık Ltd. and its owner Mustafa Yigit Zeren. The lawsuit states that the defendants failed to repay the bank’s loan debt of approximately $600 million.

Mustafa Yigit Zeren, the head of the Zeren Holding group of companies, abused the trust placed in him and transferred $600 million, which was received from the sale of Russian oil to India, to his bank account in Dubai

How Mostrade Danışmanlık Ltd. was transferred to Mustafa Yigit Zeren

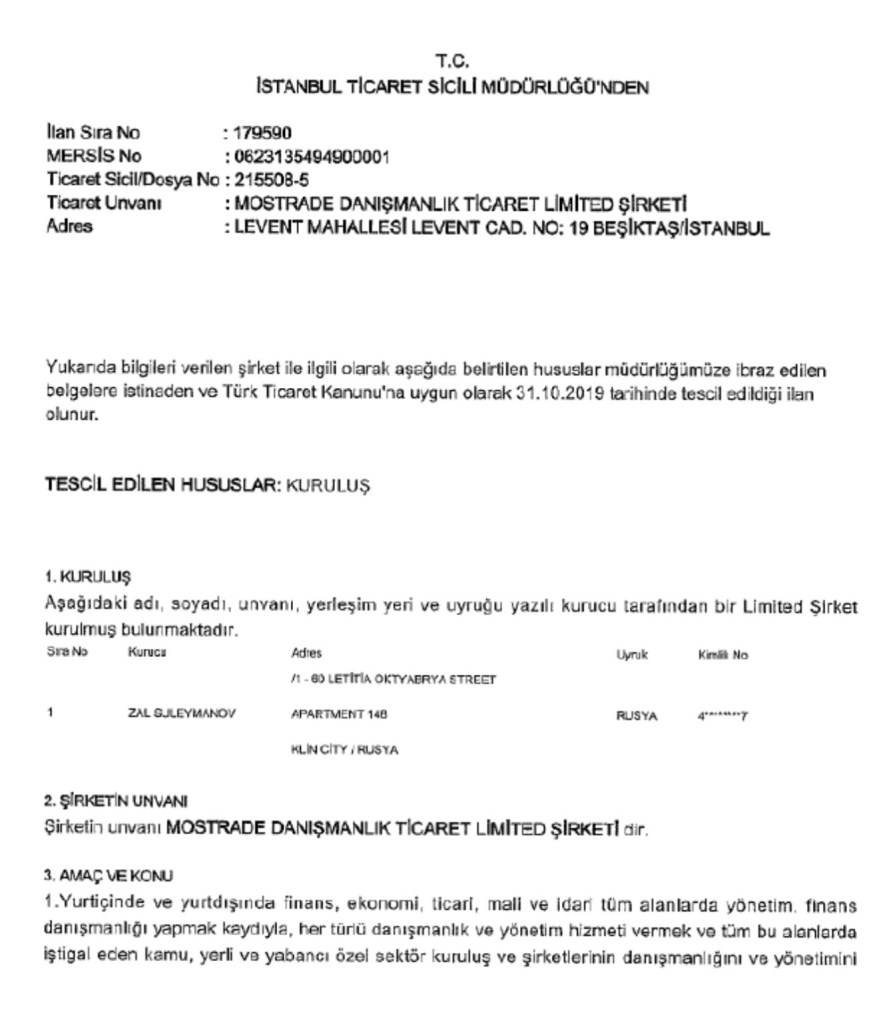

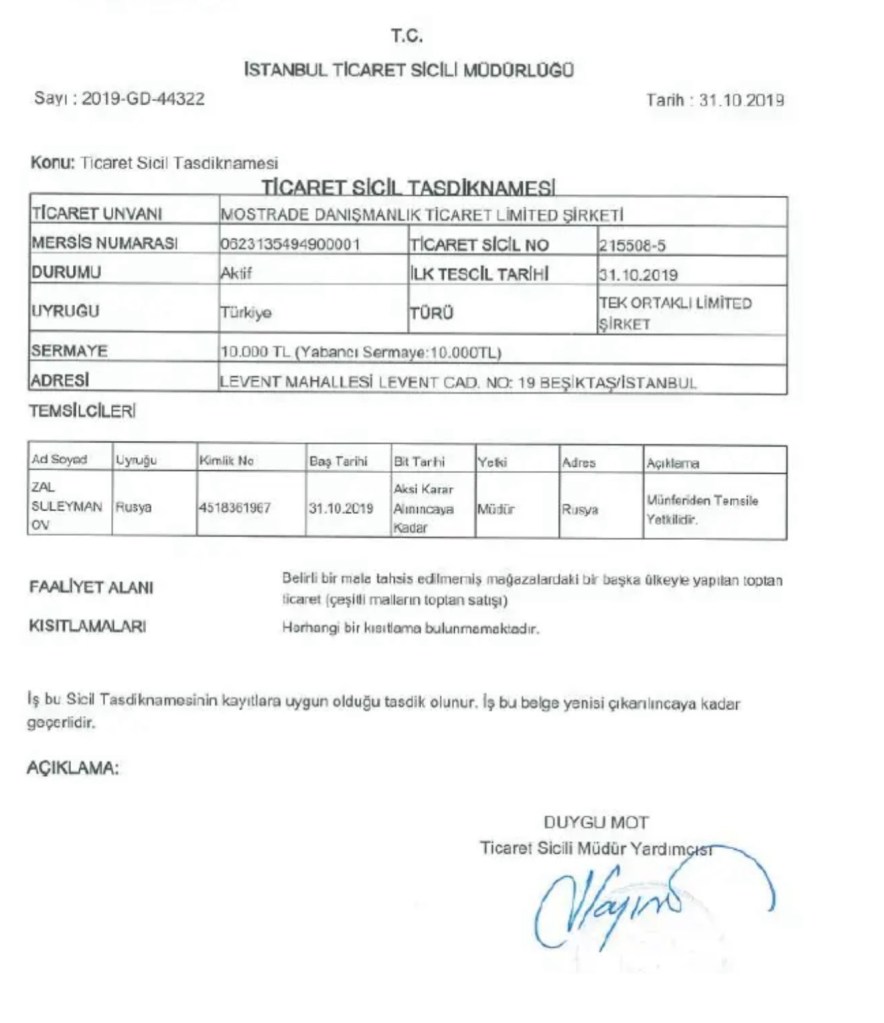

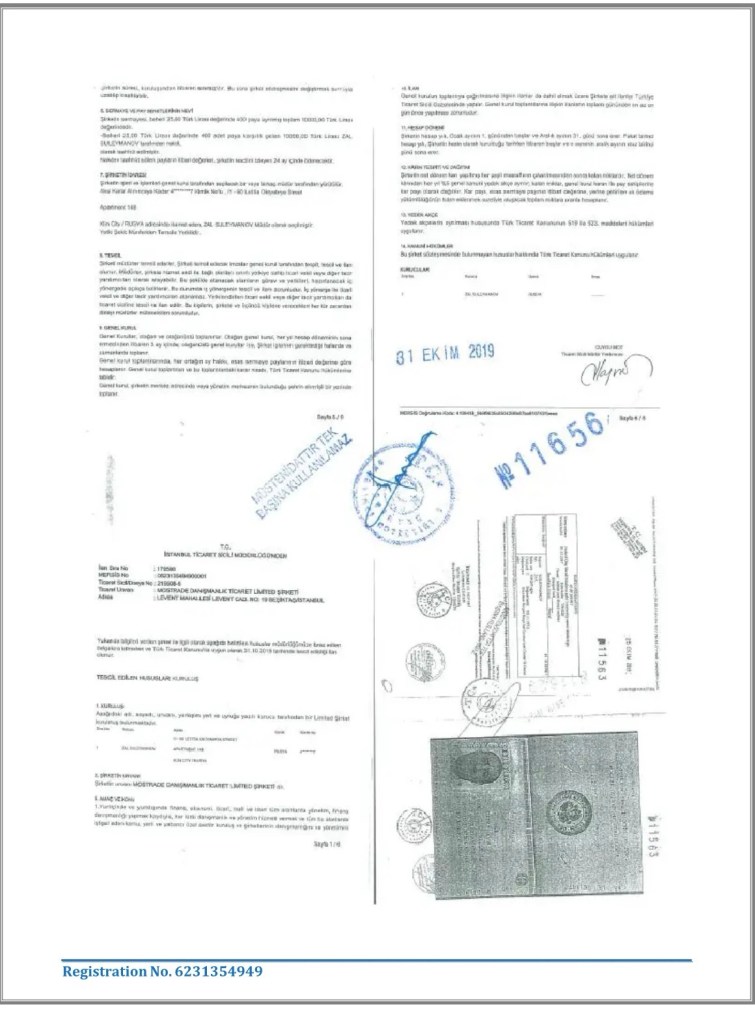

The company Mostrade Danışmanlık Ltd. (hereinafter Mostrade) was founded in 2020 in Turkey by Azerbaijani businessman Zal Suleymanov and was engaged in not very significant import-export operations, the total volume of which did not exceed one million dollars.

Zeren stole money from a Moscow bank, recently bought the Alpet company from the Altynbash family, which owned 320 gas stations in Turkey, after which Akshin Mamedov, a former employee of the Azerbaijani company SOCAR-Turkey, ended up at the head of this company.

However, after Russia’s invasion of Ukraine in February 2022, new opportunities opened up for Mostrade. Due to the sanctions imposed by the West, selling Russian oil and transferring the currency received from its sale to Russian banks became much more difficult. As a result, many Russian companies did not know how to sell oil in these conditions, and banks, accordingly, did not know how to receive money for it.

And then Mostrade offered its services as a connecting bridge between oil companies and Russian banks. These services were based on a financing system known as trade finance, according to which banks pay the cost of the sold goods to the direct supplier. According to this scheme, the sequence of the transaction looked like this: the trading company ensured the delivery of goods to the buyer at a fixed price, the buyer paid this cost to the trading company, which, in turn, fulfilled its credit obligations to the bank.

The Russian invasion of Ukraine changed the balance of power in the global oil markets… and Mostrade entered the picture

Thus, starting in February 2023, Mostrade participated in the scheme for selling Russian oil to India under sanction prices, financed by the Russian Moscreditbank.

However, before that, back in the first quarter of 2022, the owner of Mostrade changed. Zal Suleymanov, who was the sole owner of this company, transferred it to Turkish citizen Mustafa Yigit Zeren, since legal entities that did not have Turkish citizenship could not open accounts in banks in this country.

And once the company was transferred to Mustafa Yigit Zeren, he became the only person with access to Mostrade’s bank accounts in Turkey.

How was the oil sale financed?

As part of the developed sanctions evasion scheme, Moscreditbank financed the purchase of oil by paying money for it directly to the supplier company (in this case, Sechin’s Rosneft). The supplier then loaded the oil onto tankers and sent it to the destination port. The purchasing company transferred the money for the oil to Mostrade’s bank account in Turkey, which used these funds to fulfill its loan obligations to Moscreditbank with interest. It should be noted that this scheme worked without any problems until November 2023.

However, in November-December 2023, Turkish banks, under pressure from the US Department of Justice, sharply restricted money transfers to Russia. As a result, Mostrade could no longer accept money for oil sold to India into its bank accounts in Turkey and, accordingly, transfer it to Moscreditbank. However, the Russian bank, together with oil suppliers, continued to work according to this scheme, hoping that the problem with payments would soon be solved one way or another.

As part of the developed scheme to circumvent sanctions, Moscreditbank financed the purchase of oil by paying money for it directly to the supplier company

And here is how Mustafa Yigit Zeren “solved” it. As reported by the popular Turkish review finans.mynet.com, he first went to the United Arab Emirates and opened bank accounts for Mostrade there. Then, as the only beneficiary of Mostrade in Turkey, with the authority to manage bank accounts in Dubai, Zeren notified representatives of Indian companies buying oil that the problem with payments had been resolved, and they can transfer money for Russian oil (and we are talking, let us recall, about 600 million dollars) to the Dubai accounts of Mostrade.

In January and February 2024, Indian companies transferred money for oil received from Russia to the Dubai accounts of Mostrade (these payment documents can be presented – ed.), after which Zeren severed all ties with Mostrade employees, Moscreditbank and purchasing companies, publicly stating that he has no information about money, loans, etc. Zeren also completely denied his participation in the sale of Russian oil to India.(Nayara Energy )

And soon the enterprising Turkish businessman acquired the companies Alpet and Türkiye Petrolları, which own hundreds of gas stations in Turkey, while refusing to explain where he got the money for the deal, which amounts to hundreds of millions of dollars.

After Turkish media published news about the lawsuit filed by the Russian bank Moscredit against Zeren and Mostrade, Zeren Holding issued an official statement that Mustafa Yigit Zeren currently has no shares in Mostrade and that his company Zeren Holding was not a party to the loan agreement with the Russian bank.

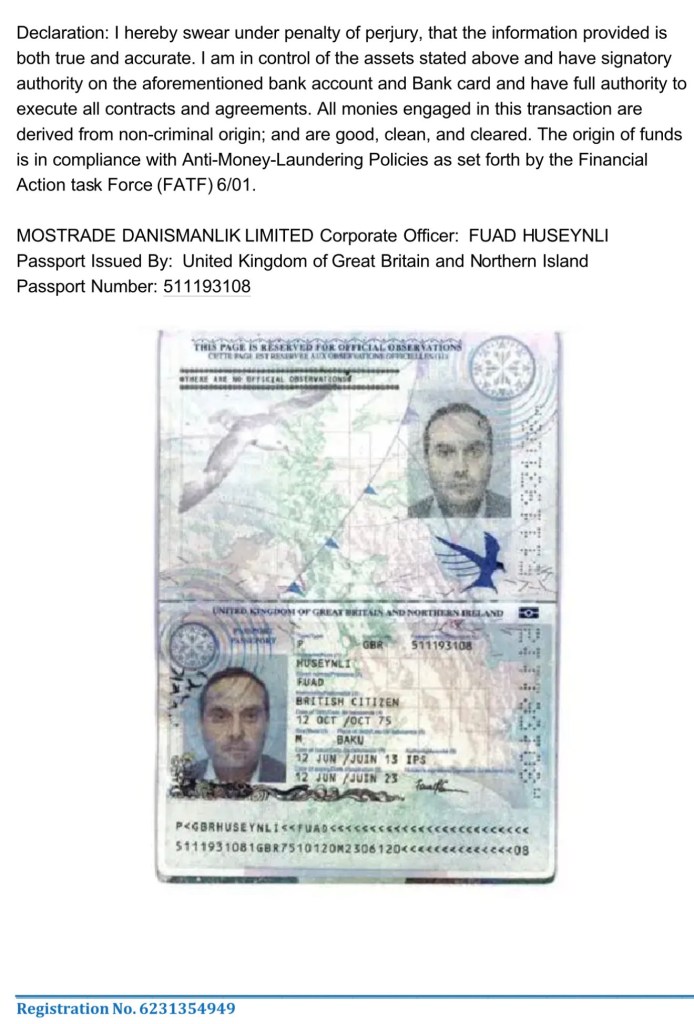

Since Fuad Huseynli was serving a prison sentence in Russia from August 2022 to March 2024, he had no contact with Mustafa Zeren

In addition, it was stated that Mustafa Yigit Zeren had previously cooperated with the actual owner of Mostrade, Azerbaijani businessman and British citizen Fuad Huseynli, but later, “disappointed” in this business partnership, he severed all ties with him.

It is important to note here that shortly before Moscredit filed a lawsuit with the Istanbul prosecutor’s office, it became known that Zeren had transferred Mostrade to another person and changed its address.

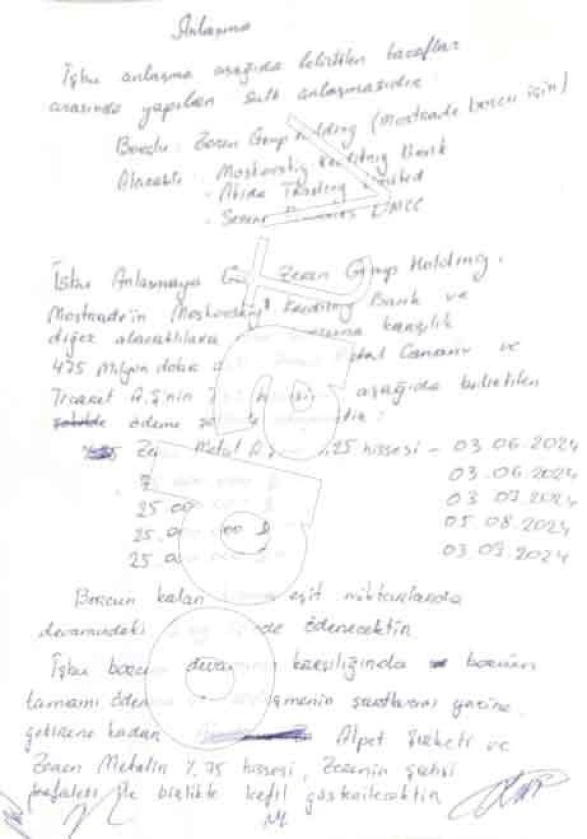

The Oda.tv publication, which is one of the most popular news portals in Turkey, publishes a photocopy of a handwritten protocol-agreement between Zeren Holding and Moscreditbank, according to which Zeren Holding undertakes to pay the Russian bank $ 475 million as compensation for the debt and 25 percent of Zeren Holding shares, which must be transferred to the Russian bank by June 3, 2024.

In addition, Zeren Holding is obliged to pay $ 150 million of the debt in installments by September 1, 2024, and the remaining debt, amounting to $ 300 million, must be paid within the next 9 months.

Despite pursuing legal and political avenues to collect the debt, Russia also deployed a team of armed men to raid the Zeren Group offices in Istanbul. During the raid, Zeren’s father, Rıdvan Zeren, who is also a board member, was coerced into signing a handwritten promissory note agreeing to pay the debt.

The note, included in the criminal complaint filed in Turkey, stipulates that Rıdvan Zeren agreed to repay $475 million in monthly installments and transfer 25 percent of the shares in the Zeren Group to the Moscow bank. As collateral for the debt collection, 25 percent of Zeren Group and 25 percent of Zeren Metal shares were listed in the note.

The note was co-signed by Nikolay Valeryevich Katorzhnov, CEO of the Credit Bank of Moscow, and witnessed by Yusuf Yatkın, CEO of the Zeren Group

On behalf of Zeren Holding, this protocol was signed by Mustafa Yigit Zeren’s father, Ridvan Zeren, who used 75 percent of the shares of Zeren Metal, owned by his son, as collateral.

The role of Fuad Huseynli in these operations

https://offshoreleaks.icij.org/nodes/39990

https://offshoreleaks.icij.org/nodes/189296

Fuad Huseynli, whose name is presented in the Turkish media as the actual defendant in the case of embezzlement of 600 million dollars from a Dubai bank, worked for a long time in the system of the Russian bank VTB. Huseynli’s responsibilities included commodity trading operations, that is, the purchase and sale of precious metals, oil and other goods for profit.

Even before Mostrade’s participation in operations to sell Russian oil to India, Fuad Huseynli’s name appeared as a witness in the case of embezzlement of funds from the Moscow branch of the International Bank of Azerbaijan and in August 2022, Huseynli was officially charged in this case. As a result, he served a prison sentence until March 2024, but then the Basmanny District Court of Moscow, having examined the case and taking into account that the accused had repaid his debt to the International Bank of Azerbaijan, released Huseynli.

Well, Fuad Huseynli is not yet showing off his new assets – in 2024, he was only released from custody in Moscow with the help of Putin’s famos oil traders, having fully compensated for the damage caused by him as a result of the theft of $4.3 million and 233 million rubles from the International Bank of Azerbaijan.

Facing pressure under Western sanctions, Russia turned to the Turkish corporate sector to facilitate global sales, hoping to leverage the US-linked Turkish banking system, which initially bypassed compliance with sanctions under orders from the Erdogan government.

UndervŞirketi (Mostrade), a small financial consulting firm established on October 31, 2019 in Istanbul by Zal Suleymanov, a Russian national of Azeri origin.

As for the founder of Mostrade, Zal Suleymanov, who is considered a close associate of Fuad Huseynli, he had no rights to manage the company’s bank accounts either in Turkey or in the United Arab Emirates. And Fuad Huseynli himself did not hold any positions in Mostrade, where the sole beneficiary was Mustafa Yigit Zeren.

In addition, since Fuad Huseynli was serving a prison sentence in Russia from August 2022 to March 2024, he had no contacts with Mustafa Zeren.

It should be noted that after his release, Huseynli tried to contact Zeren to clarify the situation, but the Turkish businessman did not want to talk to him.

The company’s initial capital was declared at 10,000 Turkish lira (approximately $1,750 at the time), suggesting it was likely a front. The real owner is reportedly Fuad Huseynli, a British-Azeri dual national who is said to have set up the company under his driver Suleymanov’s name.

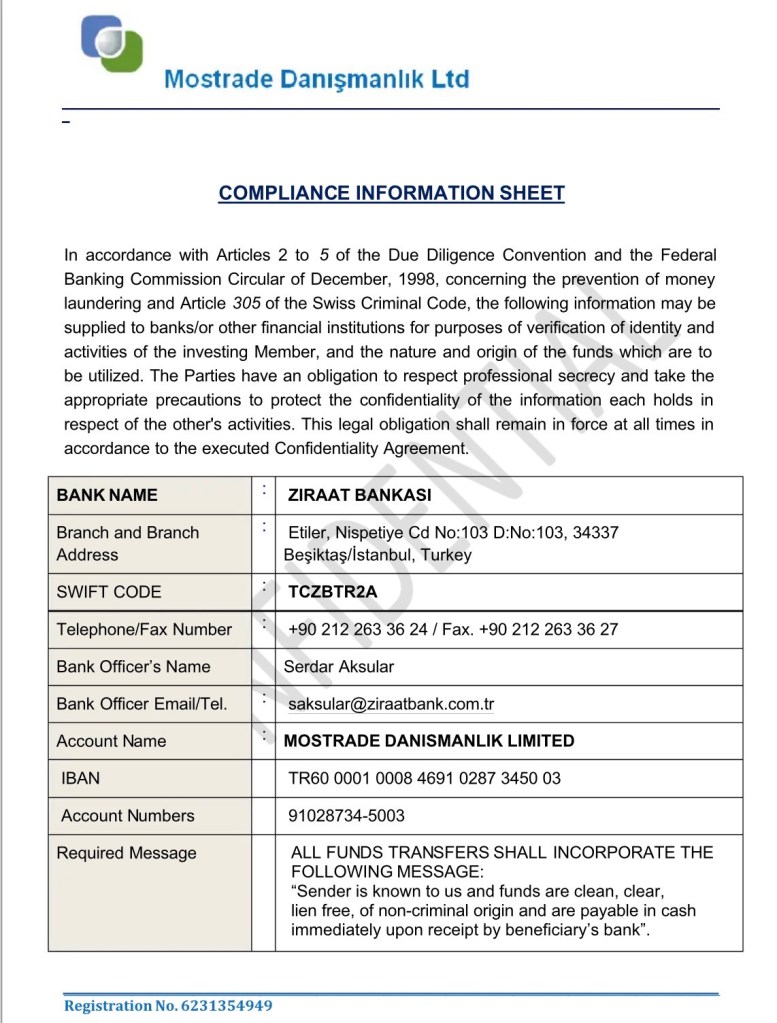

The Credit Bank of Moscow (Московский кредитный банк, MKB) extended credit to Mostrade for the purchase of Russian oil, both directly and through Akida Trading Limited, a Hong Kong-based firm with ties to MKB. On paper it appeared that Mostrade had secured a line of credit from the bank and its subsidiaries, repaying the amount owed with interest.

Trade registry records show the transfer of all shares to Mustafa Yiğit Zeren.

The intermediary who facilitated the connection between Zeren and the Erdogan family is Halil İbrahim Bacacı, a trustee for the Erdogan family who played a key role in executing the scheme. Bacacı works closely with Bilal Erdogan, with whom he shares an alma mater, the Kartal Religious High School in Istanbul. While Bacacı ostensibly has lucrative shares in mining, energy and other sectors, he is, in reality, believed to be managing the Erdogan family’s wealth as a caretaker.

After securing such powerful connections, Zeren encountered no difficulties in obtaining licenses and permits and utilizing the Turkish financial system, despite concerns raised by the Banking Regulation and Supervision Agency (BDDK), which feared potential US and EU sanctions for facilitating the trade of Russian oil.

You must be logged in to post a comment.