Reuters, citing a statement from the company, notes that Nayara Energy has appointed Teymur Abasguliyev as its new CEO. The decision was officially made by the company and he will start his position in September 2025.

According to a source from The Week (India), the appointment was approved at a meeting of Nayara’s board of directors.

Why he is a good fit: Abasguliyev is considered a good fit for the post because he has extensive experience in finance — in particular, his work as CFO at SOCAR in Turkey, which is a critical strategic need to overcome the crisis caused by EU sanctions.

🇷🇺 SOCAR Turkey and Its Connections to Russia

- Use of Russian Crude at the STAR Refinery

In 2023, Russia’s Lukoil provided $1.5 billion in financing to SOCAR Turkey to enable the continued processing of Russian crude oil at the STAR Refinery in İzmir.

This deal came after Western banks pulled out due to sanctions concerns.

The loan allowed SOCAR to restart processing Russian Urals crude, which had been halted due to sanctions pressure.

- Joint Energy Infrastructure with Russia

South Caucasus Pipeline (SCP):

Lukoil owns 19.99% and SOCAR owns 14.35% of this critical gas pipeline used to transport Azerbaijani gas to Europe via Turkey.

Baku–Novorossiysk Oil Pipeline:

Operated jointly by SOCAR and Russia’s Transneft, it remains a strategic export route from the Caspian region.

Rosneft Agreement (2016):

SOCAR Turkey and Rosneft signed a supply agreement for crude and oil products destined for the STAR Refinery.

- Turkey’s Broader Energy Dependence on Russia

As of 2022–2024, Turkey imports over 70% of its seaborne oil from Russia, making it the third-largest importer of Russian oil globally.

SOCAR Turkey, through STAR Refinery, plays a key role in processing that oil, essentially acting as a gateway for Russian crude into the Mediterranean market—particularly under sanctions.

- Strategic and Geopolitical Implications

Despite political frictions (e.g., Syria, Ukraine, NATO), Turkey maintains deep energy ties with Russia, including:

Oil & LNG flows via SOCAR Turkey infrastructure

SOCAR Turkey acts as a bridge in this strategic alignment, benefiting from both Western finance and Russian crude, navigating between EU regulations and Russian partnerships.

Have Mr. Abasguliyev warm relations with the leadership of the shadow fleet…?

Brief Report: SOCAR Tankers Transporting Russian Oil During Teymur Abasguliyev’s Tenure as Chairman of SOCAR Terminal

Teymur Abasguliyev has been serving as the Chairman of the Board at SOCAR Terminal in Aliağa, İzmir, Turkey, since December 2018 -2024

During his tenure, several tankers owned or operated by SOCAR have been actively transporting crude oil sourced from Russia to the SOCAR Aliaga Terminal. Notable Azeri-flagged Aframax tankers, including Zengezur, Shusha, and Karabakh, have been engaged in carrying Russian crude oil shipments primarily destined for the SOCAR STAR Refinery located near the terminal.

These operations occurred amid increasing international sanctions on Russian oil exports. Despite these sanctions, SOCAR utilized its own fleet, operating under the Azerbaijani flag, to continue transporting Russian crude oil to Turkey, thereby sustaining the refinery’s supply chain.

The tanker Zengezur has made multiple voyages between the Russian port of Primorsk and Turkey’s Nemrut Bay—the port serving the Aliaga Terminal and the STAR Refinery—highlighting SOCAR’s ongoing operational role during Abasguliyev’s leadership.

This involvement has drawn international attention, with some SOCAR-operated vessels being listed in sanction lists by the UK, EU for their roles in transporting Russian oil under opaque conditions.

Nayara Energy and Rosneft connection

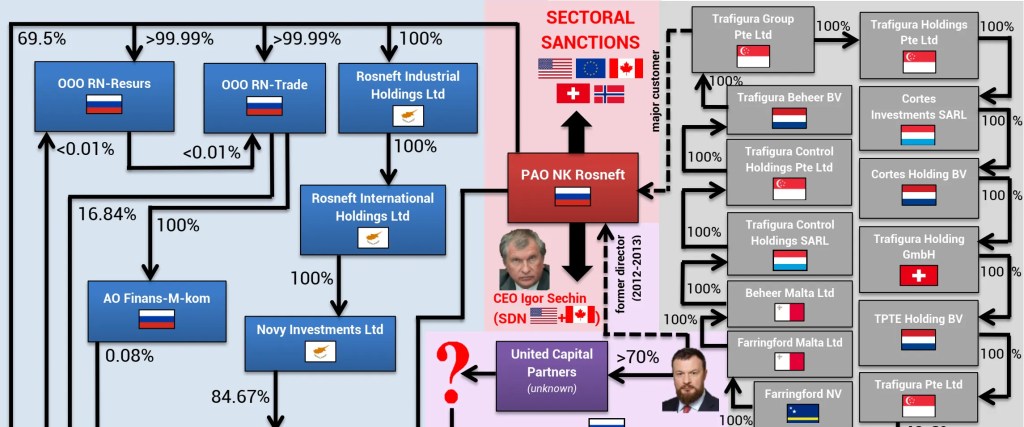

Nayara Energy is a major Indian oil refining and fuel sales company. Previously, it was “Essar Oil”, but since 2017 it has been acquired by Rosneft and a consortium of several investors (Trafigura and UCP Group).

Rosneft – Russia’s largest state-owned oil company – is one of the most important and influential shareholders in this consortium.

Rosneft CEO Igor Sechin is one of the closest figures to Vladimir Putin in the Russian political and energy elite.

Rosneft has a large stake and strategic coordination is involved when CEO appointments are approved. Sechin is certainly informed or influential in such critical appointments, especially during the sanctions era.

Sechin’s ties to India are strategic. He personally participated in the acquisition of Nayara in 2017. Now, the issues of the “swamp fleet” and oil exports related to sanctions are critical for him – in this regard, a CEO with financial experience, who can work with the region (for example, the Azerbaijani Abasguliyev) is a logical choice.

Sanctions game plan: Nayara Energy is currently trying to circumvent sanctions with a “shadow fleet”, Dubai and Asia-centric trading methods. It is not by chance who is put in charge of such a sensitive and strategic responsibility.

💼 Is there a role for Trafigura and UCP Group?

It is possible, but the Sechin-Rosneft line is more in the foreground. Because:

Trafigura and UCP act more as investment partners, but Rosneft and Sechin are more active in strategic management.

That is why the word of Rosneft is valid in the process of changing CEOs and adapting to sanctions.

✅ Conclusion:

Igor Sechin is one of the key figures who, albeit indirectly, played a role in this appointment.

The selection of Teymur Abasguliyev is in line with Rosneft’s strategic interests: he has both financial knowledge in line with sanctions, and is known as a reliable person in the post-Soviet and Eurasian regions.

This is also a balanced step to continue economic cooperation between India and Russia without “transparency”.

India’s Nayara Energy Ltd., which is facing EU sanctions for its partial ownership by Russian oil giant Rosneft, is relying on a shadow fleet to import oil and transport refined fuels, according to shipping reports and LSEG flows, Reuters reported. Nayara, which controls about 8% of India’s 5.2 million barrel-per-day refining capacity, has been struggling to transport fuel since being placed under EU sanctions in July, a move that prompted shippers to back out, forcing the refiner to cut its crude runs.

Facing EU sanctions due to Rosneft’s stake, India’s Nayara Energy is reportedly utilizing a ‘shadow fleet’ to import oil and export refined fuels. This fleet, estimated at a fifth of global tankers, helps circumvent Western sanctions by obscuring vessel identities and routes

India, the world’s third-largest oil importer and consumer, does abide by United Nations sanctions but not unilateral actions, such as sanctions on Russian oil by Western countries. That’s why it allows refiners to import oil and ship products in vessels under EU sanctions. Such vessels are part of what is called the shadow fleet or dark fleet, which evades navigational and regulatory scrutiny by Western countries and global maritime trade bodies.

As Western countries use unilateral sanctions on import of oil from countries such as Russia and Iran for their own geopolitical goals while disregarding concerns of importing countries such as India, the shadow or dark fleet of oil tankers has grown to become an efficient way to circumvent such sanctions.

The size of the shadow fleet is between 1,200 and 1,600 tankers, according to estimates from industry sources and analysts, including Lloyd’s List Intelligence and shipbroker Gibson, as per Reuters. This represents an estimated fifth of the overall global tanker fleet. Once these tankers come under Western sanctions, they can be barred from ports, have their assets frozen, or face limitations on their ability to trade or engage in financial transactions. They ignore such risks and ply in dark mode to reap potentially big profits involved in transporting sanctioned oil.

What is the shadow fleet, and how does it operate?

Tempest at sea: Nayara’s sanctioned cargo quietly slips into new hands

The shadow fleet, also called the dark fleet, refers to a clandestine network of vessels, often aging tankers, that deliberately obscure their identity, ownership, and cargo routes to slip through sanctions and international scrutiny. These ships are instrumental in transporting sanctioned goods such as oil, iron, weapons, or luxury items by exploiting sovereignty gaps and regulatory loopholes in the maritime domain. International authorities have recognised and progressively defined the shadow fleet. A resolution by the International Maritime Organization (IMO) in October 2023 was the first to officially define a “dark” ship, signaling regulatory acknowledgement of the phenomenon.

Shadow fleet operations rely on a multi-layered array of deceptive and evasive tactics. Flags of convenience and shell companies are two main tactics. Vessels are registered under jurisdictions like Liberia, Panama or other states with minimal oversight. Ownership is often hidden behind shell entities, making tracing and enforcement highly difficult. Many tankers disable or tamper with their Automatic Identification System (AIS) transponders, used for location tracking, rendering them invisible or mislocated on maritime tracking systems.Cargoes are offloaded from sanctioned vessels to seemingly clean ones, often in remote international waters, obscuring origin, ownership, or destination.Frequent renaming and reflagging or flag‑hopping are other usual tactics used by the shadow fleet. To evade detection, vessels change flags, names, management, or unique nine-digit identifiers used in maritime communication, effectively laundering their identity. Fake or non‑existent insurance and cargo manifests are used to bypass port inspections or regulatory compliance. Some ships falsify their reported positions, appearing in harmless or random locations while operating elsewhere.

Together, these techniques form a powerful system that undermines the transparency needed to enforce sanctions effectively.

Who owns and operates the shadow fleet?

Russia has developed a massive shadow fleet post‑2022. The Kyiv School of Economics estimates Russia has invested around $10 billion since then, now controlling a dark fleet accounting for 70% of its seaborne crude oil exports. The fleet consists largely of old tankers, many acquired from Western European sellers (notably Greek owners), then transferred to shell companies via foreign jurisdictions to obscure true control.

Why shadow fleet works?

Sanctions discount Russian Urals crude heavily. The shadow fleet enables buyers to tap this cheap supply by circumventing price caps. Estimates suggest Russia earns an extra $9–10 billion in revenue annually from these arrangem

One response to ““Shadow Fleet, Sanctions and Strategy: Why Nayara Energy Tapped an Azerbaijani CEO,”Sechin’s Silent Hand?”

[…] “Shadow Fleet, Sanctions and Strategy: Why Nayara Energy Tapped an Azerbaijani CEO,”Sech… […]

LikeLike