In the wake of Adnan Ahmadzade’s arrest, all shares of “Oilmar Shipping and Chartering DMCC”, a UAE-based company linked to him, were acquired by the company’s CEO Yusif Mammadov. However, this move does not absolve him from legal accountability. Yusif Mammadov must explain before investigative authorities how Oilmar DMCC generated over 1 billion USD in revenue and clarify the true sources of this income.

According to ongoing investigations, a complete “map” of the company’s financial flows and operational schemes is already in the hands of law enforcement agencies, and it is expected to serve as crucial evidence in the upcoming legal proceedings.

Since 2022, a few UAE companies have set up in the Swiss commodity trading hub of Geneva, according to the cantonal registry. Oilmar DMCC, an oil trading and chartering company, was registered shortly after Russia invaded Ukraine. Other newcomers in 2023 include Tamal Trading and Logistics and Mahsul Trading & Services.

“Geneva has always been perceived as an international and open city which offers financial and communication services for traders,” says Luciani of the University of Geneva. “There are alternatives, London for instance, but Geneva remains a central commodities centre in Europe. Trading companies have posted record profits.”

Analysis of the figures:

- Oilmar: In the 2023 financial year, Oilmar’s sales volume increased by 10% to 61.3 million tons, but the company’s profit fell from $1.56 billion in 2022 to $992.7 million.

- SOCAR: SOCAR’s total annual profit for 2023 amounted to $1.8 billion, which is only about $800 million more than Oilmar’s profit.

Albanian Police Intercept Oil Smuggling Operation Linked to Russia and Azerbaijan

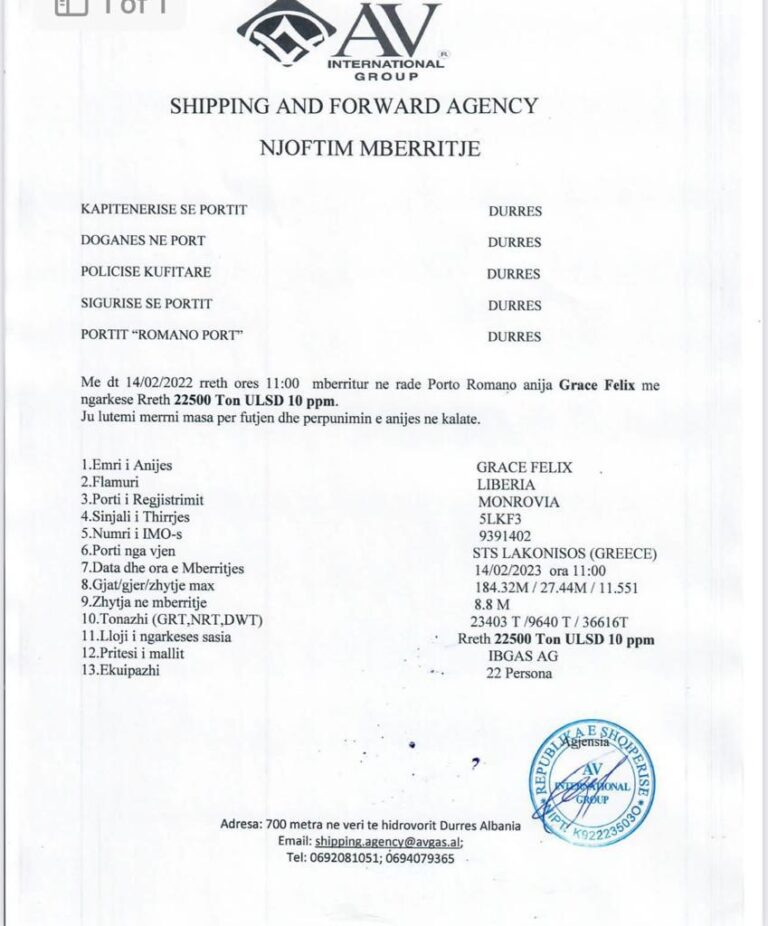

In February 2023, Albanian authorities intercepted 22,500 tons of oil at the Port of Durrës. Initial reports described the shipment as Libyan-flagged, yet official documents, satellite tracking, and investigative reporting reveal that the cargo originated from Novorossiysk, Russia.

During the investigation, authorities confirmed that the tanker’s captain is a Russian national, Alexey Smaznov. Captain Smaznov told investigators that he works on a vessel owned by a Libyan company (though the ship sails under the Liberian flag). He was able to provide a convincing explanation regarding the delivery address of the cargo and the lack of a certificate of origin for the shipment. The captain stated that he was merely the transporter and added that the oil product on board had been ordered by some Albanian and UAE (Maddox DMCC & OilMar Dmcc) companies.

Subsequently, police identified the client company as AV International Group, owned by Piro Bare, who is involved in the hydrocarbons business, and managed by Orledia Bare. Orledia Bare, as previously mentioned, serves as one of the company’s managers. Based on this information, Durres authorities contacted businessman Piro Bare and visited the AV International Group office.

Piro Bare explained to police that he was negotiating with companies from Malta and the United Arab Emirates to purchase a certain amount of oil for delivery to Albania. He stated that the company he had ordered from and exchanged several emails with is called Ses Dmch Group. According to Bare, the oil was sourced from Russia, but the company’s documents falsely indicated Libya as the country of origin.

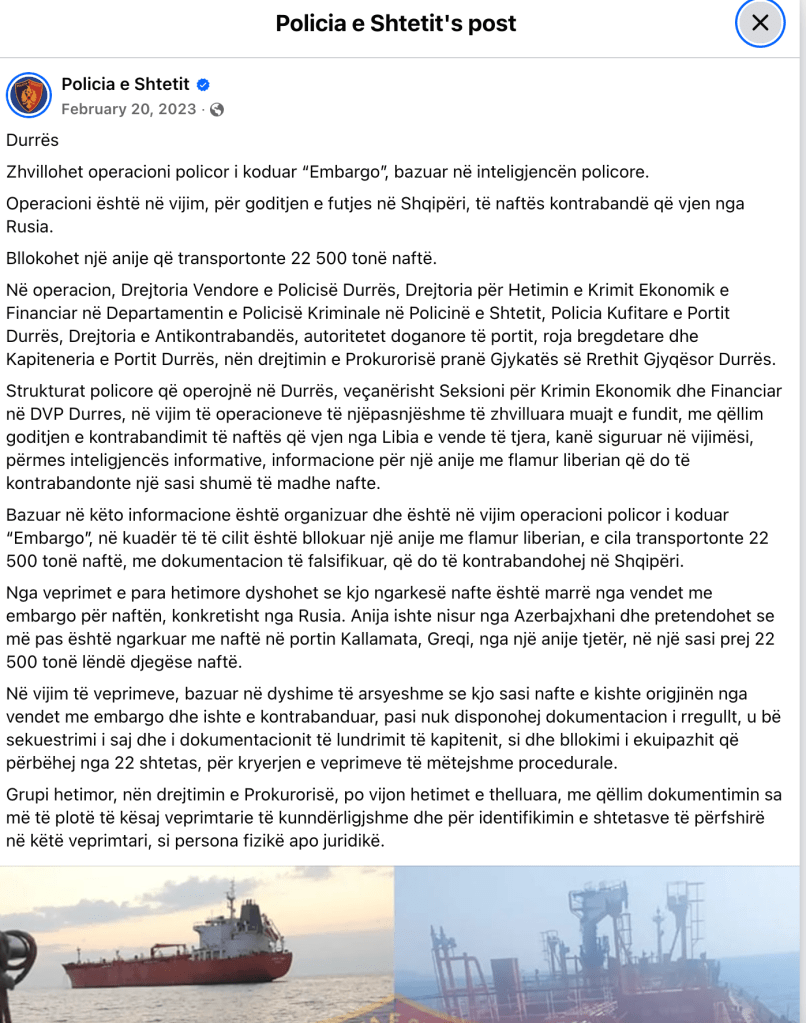

The sequence of events leading up to the police operation was as follows: when the vessel entered the Adriatic Sea, Piro Bare submitted documents to the Durres port customs for unloading the cargo into containers at Albania’s Porto Romano. Due to document issues, Bare could not clear customs and decided to cancel the delivery because of the complicated procedures at Durres port. Meanwhile, the tanker, suspected of originating from Russia, remained at sea and was subsequently seized.

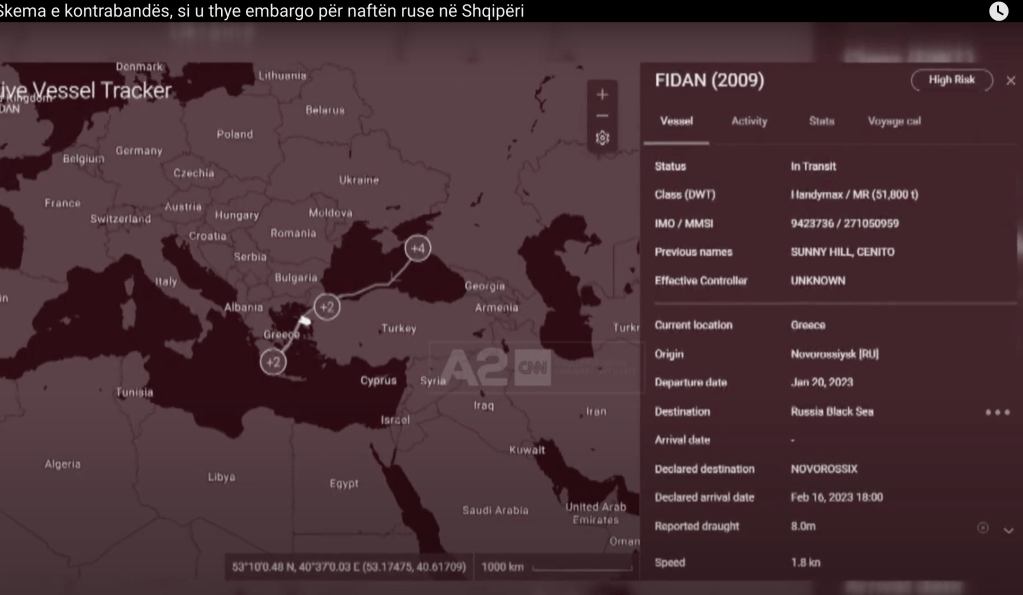

Further details clarify the origin of the tanker FIDAN, allegedly arriving from Azerbaijan. According to Albanian police, the FIDAN (IMO: 9423736) is a chemical tanker built in 2009, currently sailing under the Turkish flag. Officials note that the executives of Maddox DMCC, OilMar DMCC,Socar Trading,Almedia(Turkey) involved in the operation, are all from Azerbaijan.

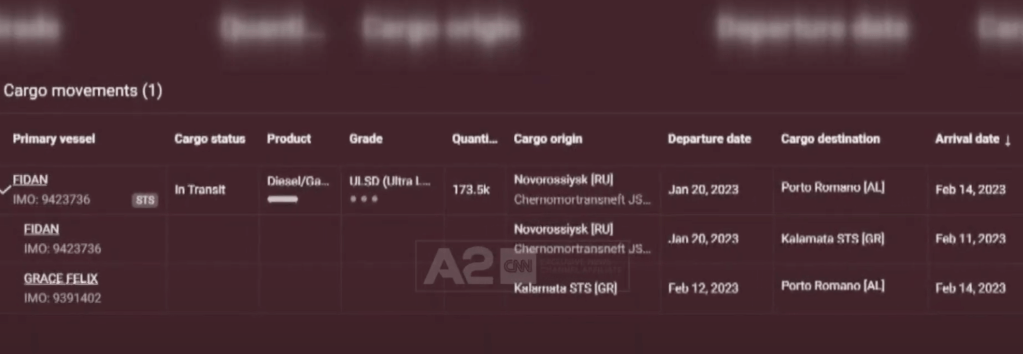

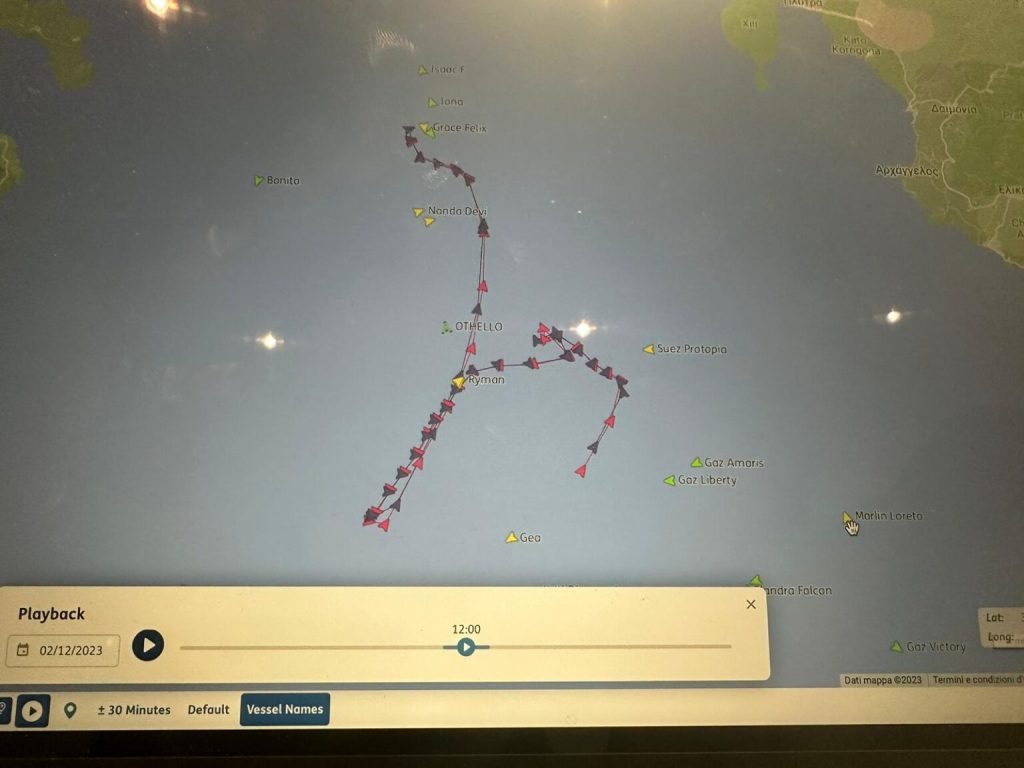

It was reported that the cargo was delivered to a Greek port by the FIDAN, which had been loaded on January 20 in the Russian port of Novorossiysk. This information aligns with data released by a cargo and vessel-tracking center.

The Durres prosecutor’s office states that the ship was managed by an Azerbaijani company and that the oil had been loaded from the Russian port of Novorossiysk on the Black Sea. Albanian media have expressed surprise that Azerbaijan was mentioned in such a controversial operation

Oilmar Dmcc and Maddox Dmcc Albania 22500 ton Russian oil

According to the Albanian Police report, the operation involved the Economic and Financial Crime Unit in Durres, which had received information about a Liberian-flagged vessel involved in smuggling a large quantity of oil. Based on this intelligence, authorities organized a police operation, codenamed “Embargo”, preventing the vessel from transporting oil to Albania using forged documents. The shipment was suspected to originate from countries under oil embargo, specifically Russia via the port of Novorossiysk.

The operation involved sophisticated ship-to-ship (STS) transfers in Greek territorial waters, falsification of certificates of origin, and coordination among multiple offshore companies.

The companies identified in these operations include Oilmar Shipping DMCC (Dubai), Maddox DMCC, Almedia (Turkey), and allegedly SOCAR Trading . These actors are implicated in transporting Russian-origin oil to European markets while circumventing UN and EU sanctions.

Click Watch Video

The 2023 Durrës Operation

According to Albanian police reports and media investigations:

- The oil cargo was 22,500 tons, loaded onto the vessel “Grace Felix”, registered under a Libyan flag to obscure its true origin.

- Satellite tracking shows the oil was initially loaded onto the “FIDAN” vessel in Novorossiysk, Russia.

- Subsequently, the oil was transferred STS in the Greece’s Lakonikos Gulf to the “Grace Felix” to conceal its Russian origin.

- Certificates of origin were falsified to claim a non-Russian source, enabling the shipment to bypass sanctions that Albania and the EU have imposed on Russian energy imports.

The operation demonstrates a sophisticated cross-border oil smuggling network, combining maritime logistics expertise, offshore corporate structures, and document manipulation to evade international oversight.

Companies and Ownership Structure

The key corporate actors in this operation are:

- Oilmar Shipping DMCC (Dubai): A relatively young trading company, primarily focused on buying, selling, and transporting oil and petroleum products globally. Oilmar’s structure allows flexible operations and high profit margins, often through offshore arrangements.

- Maddox DMCC : Acts as a regional logistics and trading facilitator, reportedly coordinating shipments from the Eastern Mediterranean to European ports.

- Almedia (Turkey): Another affiliate used to navigate regional shipping regulations.

- SOCAR Trading While SOCAR is a large state-owned enterprise with extensive upstream and downstream operations, these subsidiaries reportedly enabled parts of the trading network. The relationship between SOCAR and these offshore entities raises serious questions about corporate oversight and regulatory compliance.

Notably, the official police report confirms that the operation was not just a standard trading activity. The purpose was clearly to maximize profit by circumventing international sanctions.

Legal and Regulatory Implications

The Durrës case raises multiple serious legal issues:

- Sanctions Evasion: UN and EU sanctions prohibit the import of Russian oil under specific conditions. Misrepresenting origin violates these sanctions.

- Document Forgery: Certificates of origin were allegedly falsified in Greek territorial waters. Forgery of trade documents is a criminal offense under multiple jurisdictions.

- Money Laundering Risk: Offshore corporate structures and complex financial transfers may conceal illicit profits.

- Maritime Law Violations: STS operations in territorial waters must comply with port state control regulations. Failure to do so may constitute a breach of international maritime law.

- Corporate Oversight: SOCAR Trading’s indirect involvement raises questions about the state-owned entity’s responsibility for compliance and ethical trading practices.

Comparing Oilmar and SOCAR

The contrast between Oilmar and SOCAR illustrates how corporate structure and operational focus impact profitability and legal exposure:

- Section: Profit Paradox – SOCAR vs Oilmar

- One of the most striking observations in the 2023 Albania case is the profit disparity between SOCAR’s state-backed operations and small trading firms like Oilmar.

- SOCAR: Owns and operates large-scale production and refining assets, including Petkim, STAR refinery, and two additional oil refining facilities in Azerbaijan and the Caspian region. SOCAR’s combined annual crude oil production reaches over 500 million barrels, yet the net profit reported by the state-owned company is relatively modest, around $500 million annually, after accounting for operational costs, capital expenditures, and regional development investments.

- Oilmar DMMC / Adnan Ahmedzade’s proxy companies: In contrast, in just four years, these small, agile, offshore trading firms reportedly,trades Russian crude oil , achieved $1 billion in net profit. Their model focuses on high-margin trading, ship-to-ship transfers, and offshore structuring, allowing them to circumvent capital-intensive investments, operational overhead, and regulatory transparency required of SOCAR.

- This stark contrast raises multiple questions:

- Profit Concentration in Trading: How can relatively small proxy companies generate twice the net profit of a large state-owned corporation with massive upstream and refining capacity?

- Regulatory Oversight: Are state-owned entities adequately monitoring the trading activities of affiliated or proxy companies abroad?

- Sanctions and Compliance: Do aggressive trading schemes — such as the STS operations revealed in Albania — exploit gaps in EU and international sanctions enforcement to achieve outsized profits?

- In essence, the case demonstrates a profit paradox: large-scale production and refining operations with massive output and overhead generate smaller net profits, while small trading firms, leveraging complex international networks and regulatory gaps, can produce disproportionately high returns.

- Implication for Authorities: This discrepancy highlights the need for enhanced scrutiny of proxy companies, offshore trading structures, and cross-border operations, particularly when state-owned energy assets and public interest are indirectly involved..

Despite SOCAR’s scale and market presence, reports indicate that its indirect participation via affiliated entities enabled high-risk, high-profit operations similar to those executed by Oilmar, highlighting potential gaps in corporate oversight.

Why UK and EU Authorities Should Reopen the Investigation

Given the transnational nature of the operation and its potential to undermine EU sanctions and maritime regulations:

- Transnational Operations: Oil moved from Russia → Aegean Sea → Albania (and attempted Spain), involving multiple jurisdictions.

- Document Falsification: Certificates of origin were reportedly manipulated to disguise Russian oil as from other countries.

- Maritime Safety and Compliance: STS operations in territorial waters may contravene international maritime regulations.

- Financial Oversight: Offshore structures may conceal illicit profits, necessitating forensic financial investigation.

- Public Accountability: Corporate rebranding or leadership changes do not absolve legal responsibility; transparency is required.

- Although these individuals are not currently named in the criminal investigation, Albanian police reports list their companies as participants in the Durres port operation. Therefore the directors — Yusif Mammadov (Oilmar DMCC), Rovshan Tamrazov (Maddox DMCC) the director of Socar Trading (country of registration unknown), and the directors of Almedia (Turkey) — must be summoned to testify, given their company roles and the companies’ reported involvement in the suspected oil-smuggling operation.

- If the case falls within the jurisdiction of the Azerbaijani authorities, including the Prosecutor General’s Office of Azerbaijan, they may open a criminal investigation and question the citizens mentioned, as the official reports from Albanian police and prosecutors explicitly reference Azerbaijan

Renewed investigation would reinforce EU sanctions enforcement, promote corporate accountability, and deter future smuggling operations.

The little-known Dubai-based company Oilmar Shipping and Chartering has made dirty money over the since 2018 year as a regular carrier of crude oil and oil products from the Black Sea, mainly as if from Azerbaijan’s state oil company SOCAR, but mainly as a carrier of Russian oil.

We have obtained certain documents relating to Oilmar Shipping and Chartering’s oil operations in the Black Sea

Call to Action

Public awareness and regulatory vigilance are crucial. We urge:

- UK authorities: National Crime Agency (NCA) and Office of Financial Sanctions Implementation (OFSI) to review the case.

- EU authorities: Europol, European Maritime Safety Agency (EMSA), and European Commission (Sanctions/EEAS) to coordinate a transnational inquiry.

- Albanian authorities: Port of Durrës, Prosecution, and Financial Intelligence Unit to share records, AIS tracking, and police evidence.

The Durrës operation is not merely a corporate scandal; it represents a broader threat to international law, EU sanctions, and energy market integrity. Renewed investigation is essential.

Conclusion

The 2023 Albania oil smuggling case exposes a coordinated network using Oilmar, Maddox Dmcc ,Almedia, and SOCAR Trading to transport Russian oil under falsified documents across Europe. The operation demonstrates how small, agile trading companies can exploit gaps in oversight, even when a large state-owned entity is involved.

For the public, regulators, and investigative journalists, the lesson is clear: transparency, accountability, and rigorous enforcement of international sanctions are indispensable to prevent illicit trade and maintain market integrity.

This analysis is based on open-source intelligence, public records, and documented sanctions violations. All allegations require formal investigation by appropriate authorities.