According to S&P Global Commodity Insights and other energy analysts, India’s imports of Russian-origin crude oil could rise further in November, as refiners rush to secure shipments ahead of the U.S. sanctions wind-down deadline of November 21, imposed on Rosneft and Lukoil.

In October, India’s imports of Russian crude averaged 1.69 million barrels per day (b/d), up from 1.64 million b/d in September. Analysts note that the spike reflects higher domestic demand during the festival season and a rush to secure barrels before U.S. sanctions take full effect.

Impact of Sanctions and Alternative Supply Preparations

Following new measures by the U.S. and EU, Indian refiners have already started:

negotiating long-term deals with suppliers from North America, Africa, and South America, exploring alternative sources in addition to traditional suppliers, preparing for potential disruptions once sanctions fully apply in December.

Premasish Das, Executive Director for Oil Analytics at S&P Global Commodity Insights, said:

“Russian crude flows to India in November could even exceed October levels, as refiners push to secure barrels before sanctions on Rosneft and Lukoil take effect.”

Nayara Energy: Sanctions and Russian Crude Procurement

Nayara Energy has faced particular challenges after EU sanctions in July 2025:

Restrictions disrupted purchases from non-Russian suppliers, Financial and logistical operations were constrained, Access to alternative crude sources was limited.

To maintain operational throughput, Nayara increased its Russian crude purchases substantially. According to CAS, in the week ending November 2, Nayara imported 420,000 b/d of Russian crude to its Vadinar refinery terminal — more than double the volume prior to EU sanctions targeting the company.

Tushar Bansal, Senior Director at Alvarez & Marsal, noted:

“EU sanctions disrupted Nayara’s access to other suppliers, which forced the refinery to rely more heavily on Russian crude to maintain throughput.”

Indian Refiners’ Strategies

Indian Oil Corp. continues sourcing only from unsanctioned entities, HPCL-Mittal Energy announced suspension of Russian crude purchases, Nayara Energy is awaiting official guidance from the Indian government.

This reflects the delicate political and operational balancing act facing Nayara Energy.

Analyst Perspective: Potential Pressure on CEO

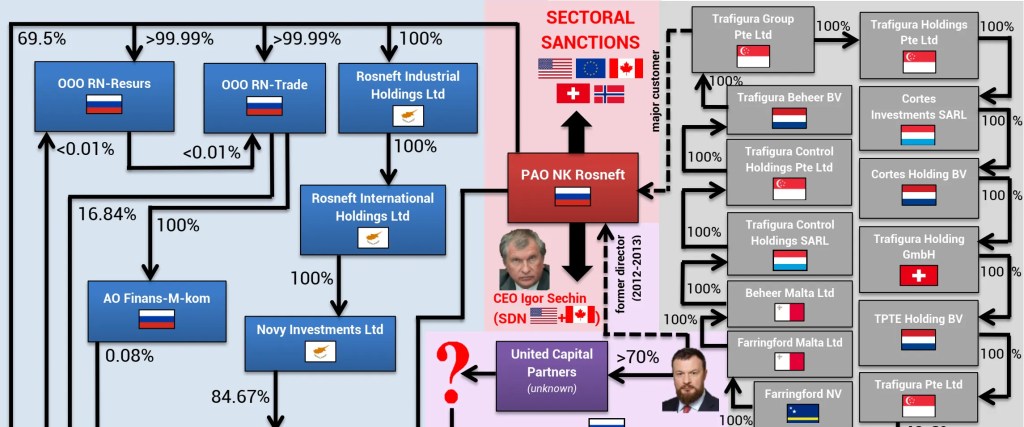

Reputable sources confirm that sanctions primarily target companies and entities such as Rosneft, Lukoil, and their subsidiaries.

Expecting credible report that U.S. or EU authorities plan to sanction Nayara CEO Teymur Abasguliyev personally, analysts speculate:

“If U.S. and EU sanctions expand, they could eventually exert political or financial pressure not just on companies, but potentially on senior executives managing Russian-linked operations.

This includes Nayara Energy’s CEO, Teymur Abasguliyev.”

It is important to stress that this is risk analysis and geopolitical speculation, not an official sanction plan.

Conclusion (Publication-Ready Summary)

According to S&P Global, CAS, and Reuters, upcoming U.S. and EU sanctions will significantly impact India’s trade in Russian crude. Analysts suggest that if the sanction scope widens, pressure could extend beyond companies to include executives managing critical operations — including Nayara Energy’s CEO — though this remains unconfirmed risk analysis, not a confirmed policy.

✅ Highlights for November 2025

Operational throughput: Nayara’s Vadinar refinery operates at ~90–93% capacity, showing resilience post-sanctions. Russian crude imports: October saw 1.69 million b/d; November inflows may increase further before the U.S. sanctions deadline. Strategic supply diversification: Indian refiners are negotiating with North/South America, Africa, and traditional suppliers to reduce dependency. Regulatory compliance: Nayara and other Indian refiners carefully navigating sanctions and government guidance.

Speculative executive pressure: Analysts note potential indirect pressure on Nayara CEO Teymur Abasguliyev if sanctions expand, but still no official sanctions are in place.

Leave a comment