Dubai — Despite stringent EU, UK, and US sanctions on Russian energy exports, a network of former senior traders from global commodity giants Trafigura and Vitol appears to be maintaining Russian oil and product trading through Dubai-based intermediaries, according to industry sources and corporate filings.

Two companies are at the center of these flows: Patera Middle East DMCC and Forteza Trading DMCC. Both firms employ former high-profile traders and executives from Trafigura, Vitol, and Lukoil’s now-liquidated trading arm, Litasco Middle East Trading.

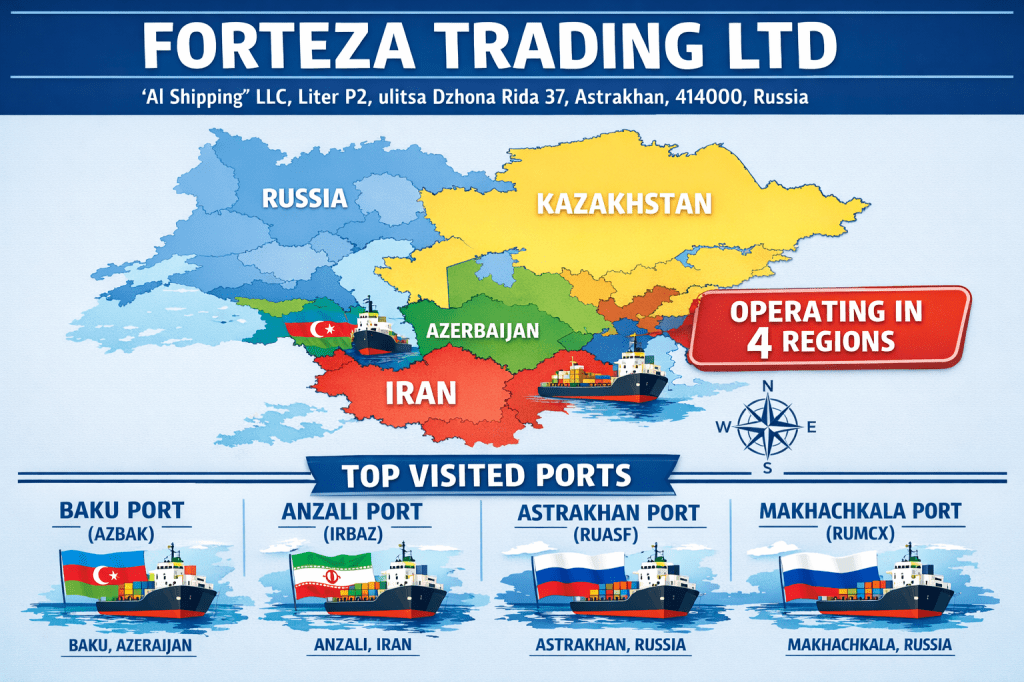

List of top visited ports of FORTEZA TRADING

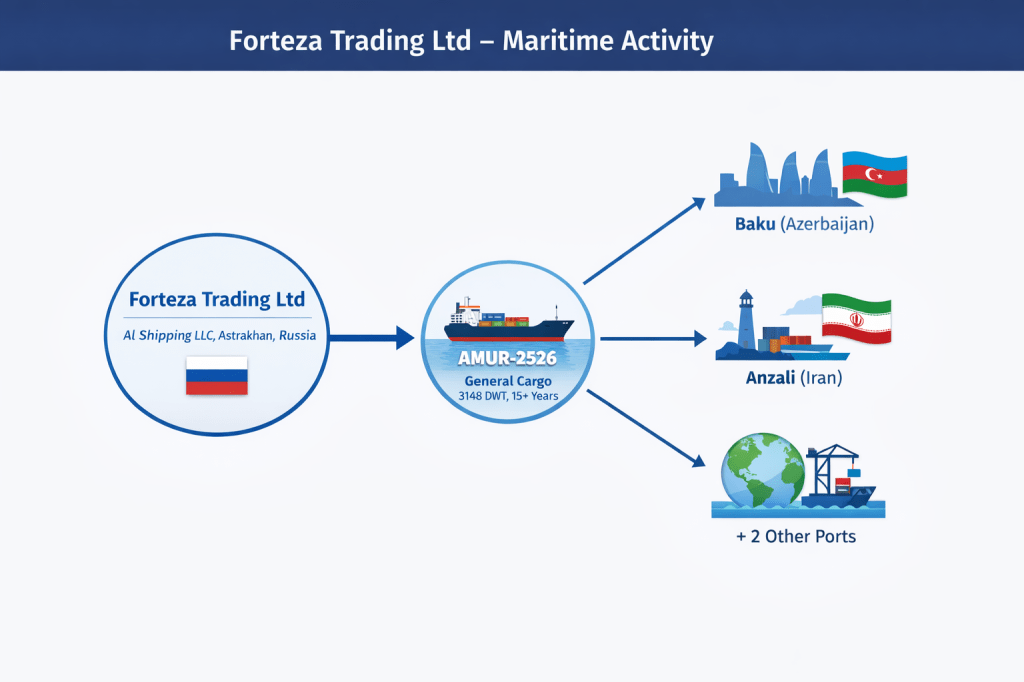

“Forteza Trading Ltd has been linked in industry reporting to the trading of Russian oil products via Dubai‑based intermediaries, and maritime tracking data shows its vessels have operated in ports such as Baku (Azerbaijan) and Anzali (Iran), raising questions about its involvement in regional oil logistics that could include Russian, Azerbaijani and Iranian shipments.”

https://magicport.ai/owners-managers/russian-federation/forteza-trading-ltd

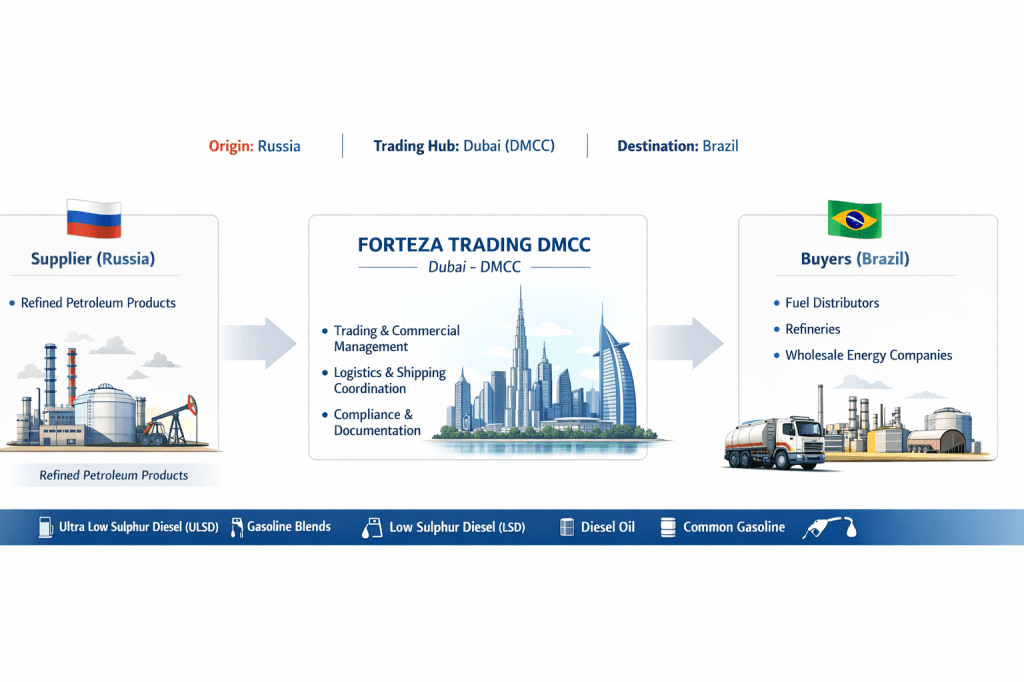

Russian Origin Suppliers

(refined petroleum products)

│

▼

FORTEZA TRADING DMCC

(DMCC – Dubai, UAE)

- Trading & Risk Management

- Logistics Coordination

- Compliance & Documentation

│

▼

Brazilian Fuel Distributors - Refineries

- Wholesale Fuel Traders

- Energy Distribution Companies

Russia Export History – Detailed Trade Overview

Company Export Data Overview

FORTEZA TRADING DMCC operates as an international commodities trading company with a proven track record in facilitating the export of Russian-origin energy and fuel products to global markets.

Based on available historical trade records, the company has supported cross-border supply chains connecting Russian producers with industrial buyers and refiners across Asia and the Middle East.

Trade Flow Structure (Horizontal Model)

Russia (Country of Origin)

→ FORTEZA TRADING DMCC

(International Trading & Coordination – Dubai, DMCC)

→ Destination Markets

(India & Turkey) Products Traded

The historical export records indicate trading activity in the following commodity groups:

Refined Petroleum Products

• Naphtha

– HS Code: 27101229

– Used primarily as refinery feedstock and for petrochemical production

Solid Fuels

• Petroleum Coke (Non-Calcined)

– HS Code: 27131100

– Industrial fuel for cement, metallurgy, and power generation

• PCI Coal (Pulverized Coal Injection – Bulk)

– HS Code: 27011990

– Used in steelmaking and metallurgical processes

Destination Markets & Buyers

India

FORTEZA TRADING DMCC has supplied Russian-origin products to major Indian energy and industrial entities, including:

• HPCL-Mittal Energy Limited

• Rashtriya Ispat Nigam Limited

These shipments primarily consisted of naphtha and coal-based products for refinery and steel production use.

Logistics & Ports (Sample Historical Records)

• Port of Loading:

– Ust-Luga, Russian Federation

• Ports of Discharge:

– Mundra Port, India

– Gangavaram Port, India

– Turkish industrial ports (various)

FORTEZA TRADING DMCC coordinates international logistics, shipping schedules, and documentation in cooperation with vessel operators and port authorities.

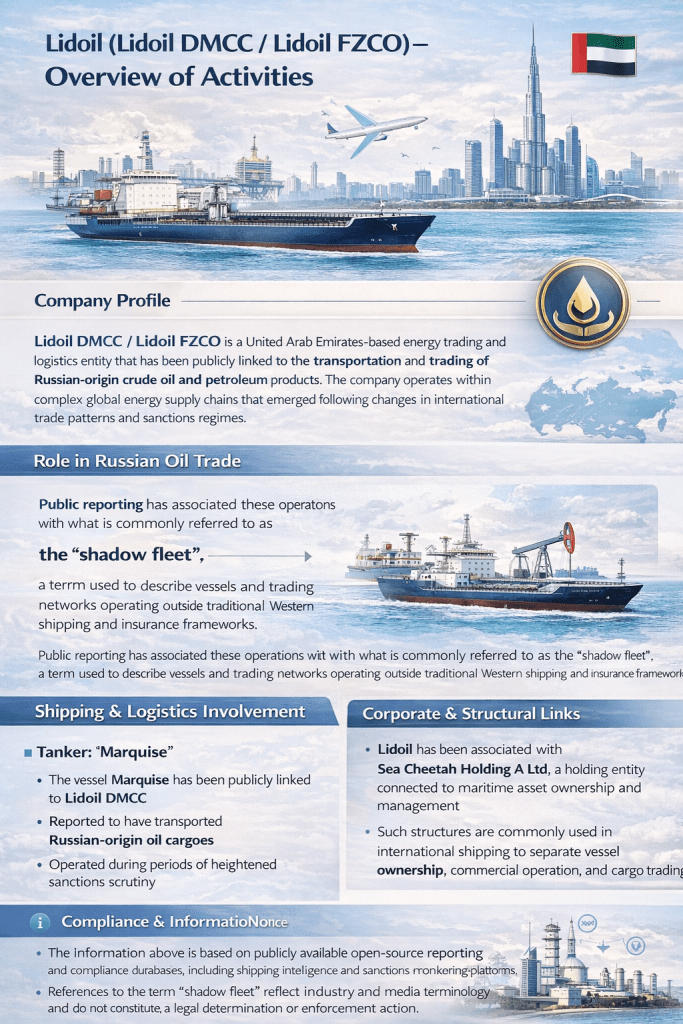

Patera Middle East DMCC (aka Samaria / Lidoil)

Patera Middle East DMCC, also known as Samaria or Lidoil, reportedly trades Russian oil products and is believed to operate with indirect support from Trafigura, although no official ownership links have been publicly disclosed.

Lidoil (Lidoil DMCC / Lidoil FZCO) – Overview of Activities

Company Profile

Lidoil DMCC / Lidoil FZCO is a United Arab Emirates–based energy trading and logistics entity that has been publicly linked to the transportation and trading of Russian-origin crude oil and petroleum products. The company operates within complex global energy supply chains that emerged following changes in international trade patterns and sanctions regimes.

Role in Russian Oil Trade

Lidoil is identified as playing a role in the commercial management and transportation of Russian oil exports, particularly during periods of restricted market access. Its activities include:

• Trading and coordination of Russian-origin crude oil and refined petroleum products

• Management of shipping structures used for international oil transport

• Engagement with third-party vessel ownership and holding structures

Public reporting has associated these operations with what is commonly referred to as the “shadow fleet”, a term used to describe vessels and trading networks operating outside traditional Western shipping and insurance frameworks.

Shipping & Logistics Involvement

Vessel Associations

• Tanker: Marquise

– The vessel Marquise has been publicly linked to Lidoil DMCC

– Reported to have transported Russian-origin oil cargoes

– Operated during periods of heightened sanctions scrutiny

According to open-source compliance databases such as OpenSanctions, the Marquise has been referenced in connection with Russian oil movements under alternative trading and shipping arrangements.

MARQUISEIMO 9315745

Cases of AIS shutdown:Yes

Calling at russian ports:Yes

Visited ports :Aliaga (Turkey), Conakry (Guinea), Dakar (Senegal), Vysotsk (russia), Golcuk Burnu (Turkey), Izmit (Turkey), Novorossiysk (russia), Porto Grande (Cape Verde), Marmara (Turkey), St. Petersburg (russia), Tuzla Shipyard (Turkey)

Available additional information

Ship Owner (IMO / Country / Date):Sea Cheetah Holding A Ltd c/o Lidoil DMCC (0397525 / United Arab Emirates / 26.11.2025)

Commercial ship manager (IMO / Country / Date):Lidoil DMCC (6424014 / United Arab Emirates / 12.04.2025)

Ship Safety Management Manager (IMO / Country / Date):Spikoil DMCC (0180902 / United Arab Emirates / 12.04.2025)

Former ship names:Agisilaos / Seaways Cape Horn / Chemtrans Leo

Flags (former): Marshall Islands /

Germany /

Liberia /

Gabon /

Barbados /

Vanuatu

Market Context

Following the imposition of international sanctions on Russian energy exports, a number of non-Western trading hubs, including the UAE, have emerged as coordination points for:

• Energy trading

• Shipping management

• Chartering and logistics structuring

Lidoil operates within this broader market environment, providing trading and logistical coordination for Russian-origin energy flows.

Company website: https://www.patera.ae

Trader connections

Links to Russian oil producers and terminals

Key individuals associated with Patera:

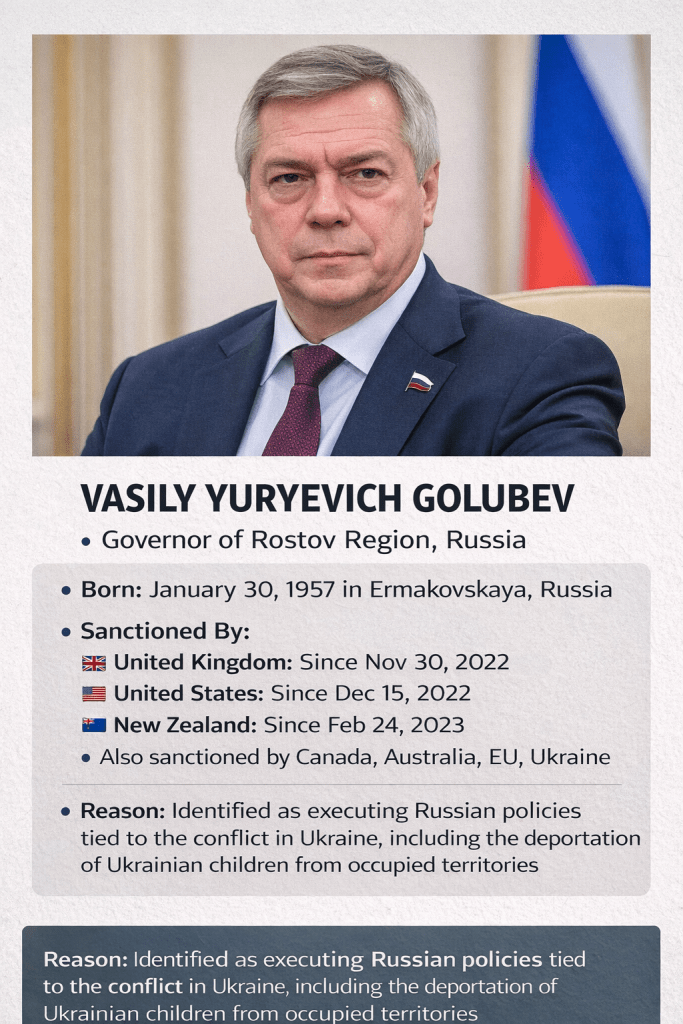

- Dmitry Golubev — former Trafigura trader and son of Vasily Golubev, Governor of Russia’s Rostov Oblast from 2010 to 2024, sanctioned by the UK government in 2022 over the Russo-Ukrainian War. (Source)

- https://www.opensanctions.org/entities/Q4142298/

- The children of Vasily Golubev, a former governor of Russia’s southern Rostov Region and a current member of the country’s Federation Council, have acquired luxury real estate in Dubai worth approximately €10.5 million ($11.5 million or around 1 billion rubles), according to a new investigation by the late Alexei Navalny’s Anti-Corruption Foundation (ACF).

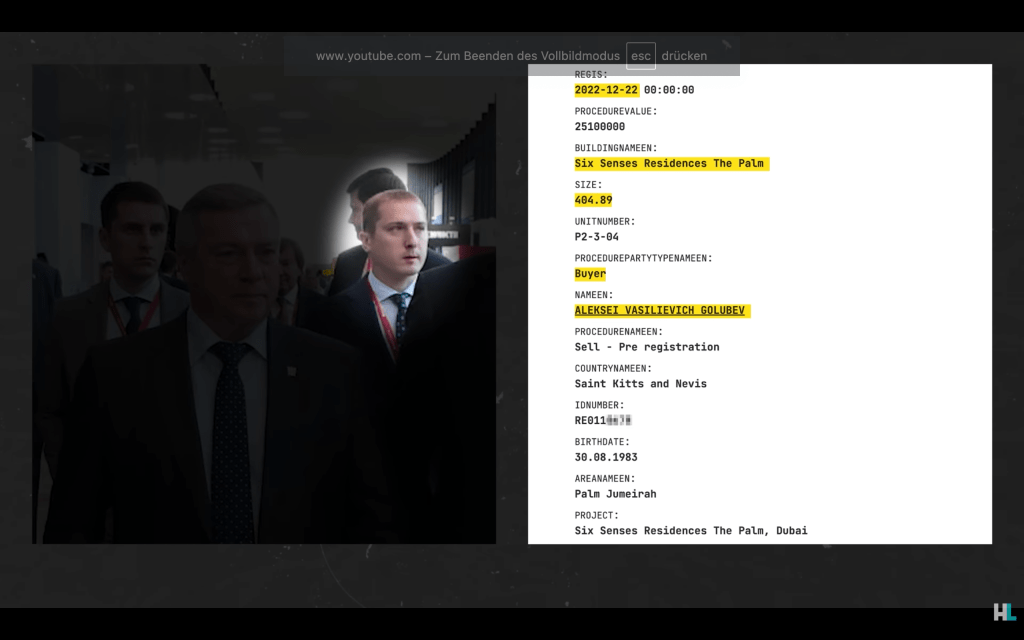

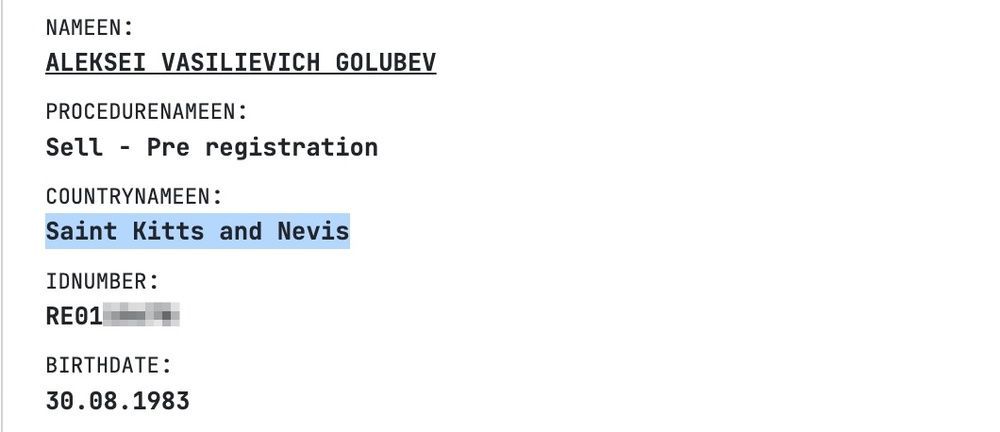

In December 2022, Golubev’s son, Alexei, purchased the family’s first property in Dubai — a 405 m² penthouse in the prestigious Six Senses Residences The Palm complex. The apartment was bought for €6.5 million (equivalent to 475 million rubles at the time of purchase). Investigators also discovered that Alexei Golubev holds citizenship of Saint Kitts and Nevis — a Caribbean tax haven.

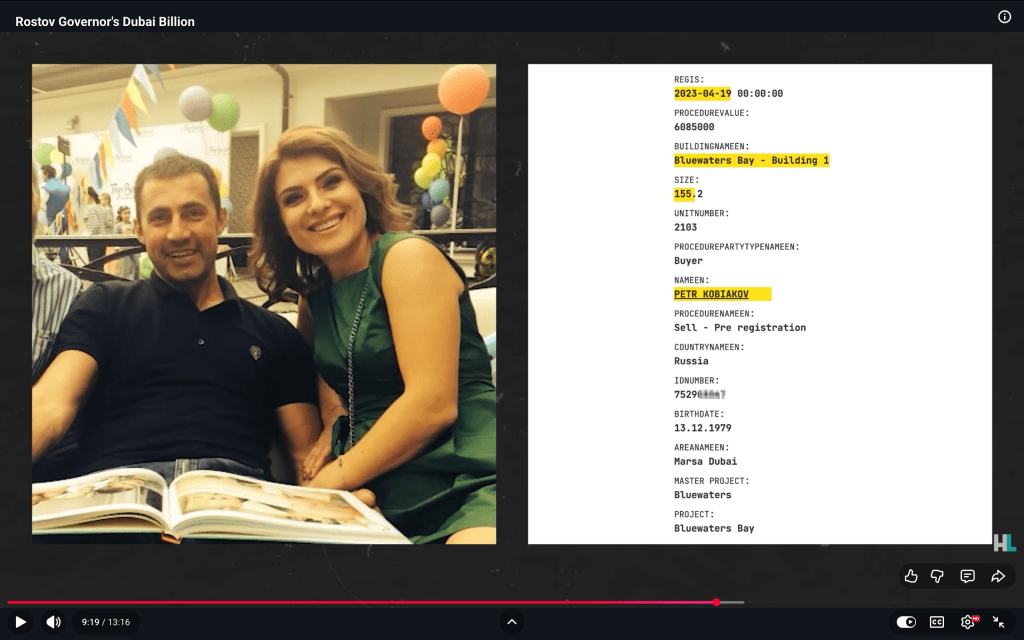

In spring 2023, Svetlana Golubeva, the former governor’s daughter, acquired two apartments in Bluewaters Bay, each measuring 122 m² — one in March and another in May. That April, her husband, Pyotr Kobyakov, also purchased an apartment in the same building.

In total, the Golubev family’s real estate acquisitions in Dubai over less than six months amount to €10.5 million.Beyond their high-end properties in the UAE, the family of the incumbent senator also owns multiple private homes and apartments in Russia, with a total estimated value of 1.5 billion rubles (approximately $18 million).

Vasily Golubev personally owns a mansion in the Vodopadny village in Rostov Region, valued at around 30 million rubles. ACF refers to Vodopadny as the “local Rublyovka” — comparing it to the eponymous ultra-elite district in Russia’s capital, Moscow.

Alexei Golubev owns a house in Agalarov Estate, an exclusive residential complex in the Moscow Region, as well as an apartment in central Moscow.

Svetlana Golubeva has two apartments in the heart of Moscow — one on Mosfilmovskaya Street and another on Arbat Street.

Vasily Golubev served as the governor of the Rostov Region from 2010 to 2024. In November of last year, he transitioned to a position in the Federation Council, the Russian parliament’s upper chamber.

- Ravil Kudyakov — former TNK-BP executive.

Industry sources indicate that Patera has become a conduit for Russian-origin oil products following the tightening of Western sanctions, utilizing Dubai’s neutral trading hub to facilitate transactions.

Forteza Trading DMCC and Vitol Connections

Forteza Trading DMCC is widely reported to be supported by Vitol, the world’s largest independent oil trading company. While Vitol officially sources Russian oil products only from “clean” or non-sanctioned producers, Forteza is alleged to deal with companies that are under sanctions, creating a parallel high-risk trading channel.

Company website: https://forteza.ae

Key figures associated with Forteza:

- Dmitry Vinogradov — former Vitol trader, described as highly successful and maintaining close ties to Vitol post-departure.

- Evgeniy Lazarev — Russian trader involved in Forteza’s founding.

- Elena Vasilieva — co-owner and Chair of the Board of Directors of JSC Petersburg Oil Terminal, a strategic Russian oil export terminal. In 2025, a Russian court seized a majority stake in the terminal from the founding family, raising questions about political connections. (Meduza)

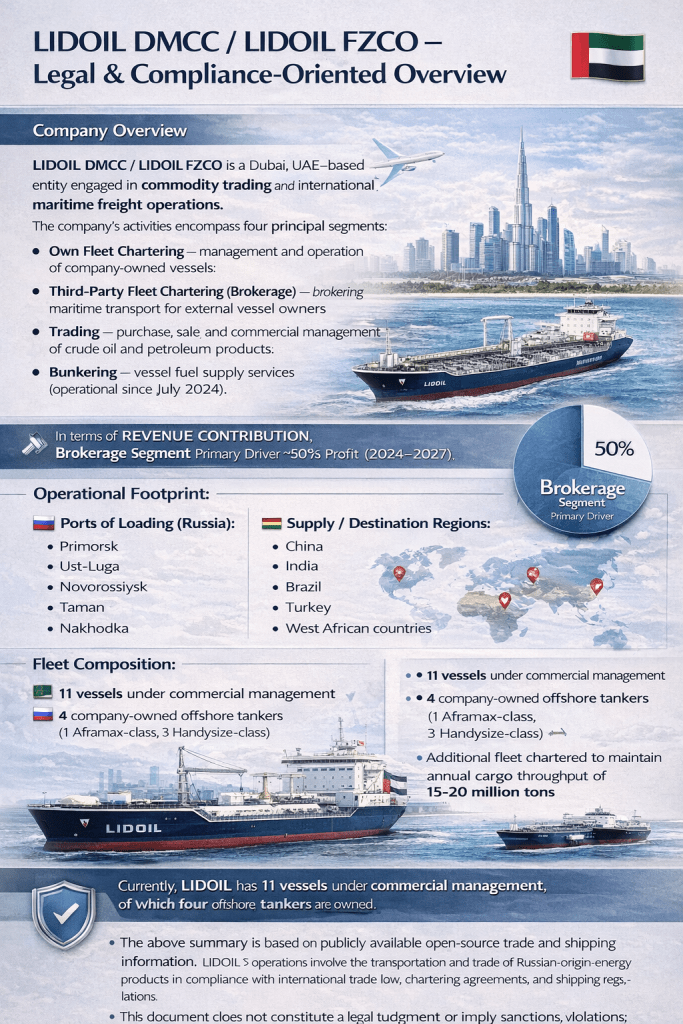

LIDOIL operates in the commodity trading (trading) and ocean freight segments.

The Company is based in Dubai (UAE). The Company operates in four segments: own fleet chartering, third party fleet chartering (brokerage), trading and bunkering. In terms of revenue, the brokerage segment dominates, with the share of chartering of own vessels in gross profit in the period from 2024 to 2027 amounting to about 50%. The Company’s customer base is quite diversified.

The main ports of loading are the ports of the Russian Federation (Primorsk, Ust-Luga, Novorossiysk, Taman, Nakhodka). Supply regions include China, India, Brazil, Turkey, and West African countries.

- In 2023-2024, the Company significantly reduced its trading activities, which are currently of a spot nature, and became a niche player in this segment, while significantly increasing the volume of freight operations and taking one of the leading positions in the brokerage segment. In addition, since July 2024, the Company has expanded the diversification of its operations by entering the bunkering business segment

Currently, LIDOIL has 11 vessels under commercial management, of which four offshore tankers are owned by the Company (one Aframax-class vessel and three Handysize-class vessels), and also attracts additional fleet with a total annual cargo turnover of 15-20 million tons.

From Patera to Forteza: A Split in Leadership

Sources familiar with the matter say that Dmitry Vinogradov, Dmitry Golubev, and Evgeniy Lazarev initially co-founded Patera. Disagreements led to a split, after which Vinogradov established Forteza Trading DMCC in partnership with the controversial Elena Vasilieva.

Influx of Former Litasco Traders

Adding further complexity, a significant number of Russian traders from Litasco Middle East Trading, the Dubai-based arm of Lukoil that has since been liquidated, have reportedly joined either Patera or Forteza.

Notable traders cited by sources include:

- Konstantin Tochilin — fuel oil trader, close to Surgutneftegas

- Ilya Zaymentsev — diesel oil trader

- Vladislav Dolgov — diesel oil, son of Denis Dolgov, former VP of Lukoil

- Nikolay Ambrosov — shipping specialist, former Commercial Director of Litasco Middle East’s shipping arm, son of Evgeniy Ambrosov (Novatek / Sovcomflot)

Implications for Regulators and Markets

While there is no public evidence that these companies have violated sanctions, the concentration of former Western trading house personnel, politically connected individuals, and sanctioned-entity exposure underscores the challenges EU, UK, and US authorities face in enforcing energy sanctions.

Dubai’s role as a neutral trading hub has become increasingly important in rerouting Russian oil flows, relying on experienced traders, complex corporate structures, and longstanding industry relationships.

This report is based on publicly available sources, corporate records, and industry interviews.

Leave a comment