Vostok-Oil is the most ambitious oil and gas project in modern Russia. It could give a new impetus to energy exports.

No less than 12 trillion rubles will be invested in the project. This is ten times more than the construction of the Power of Siberia cost. If everything goes according to plan, over 100 million tons of oil per year will be produced there in the next decade.

We figure out what Vostok-Oil is, what risks it has, and why it is so important for Rosneft, Russia’s largest oil company. What is Vostok-Oil

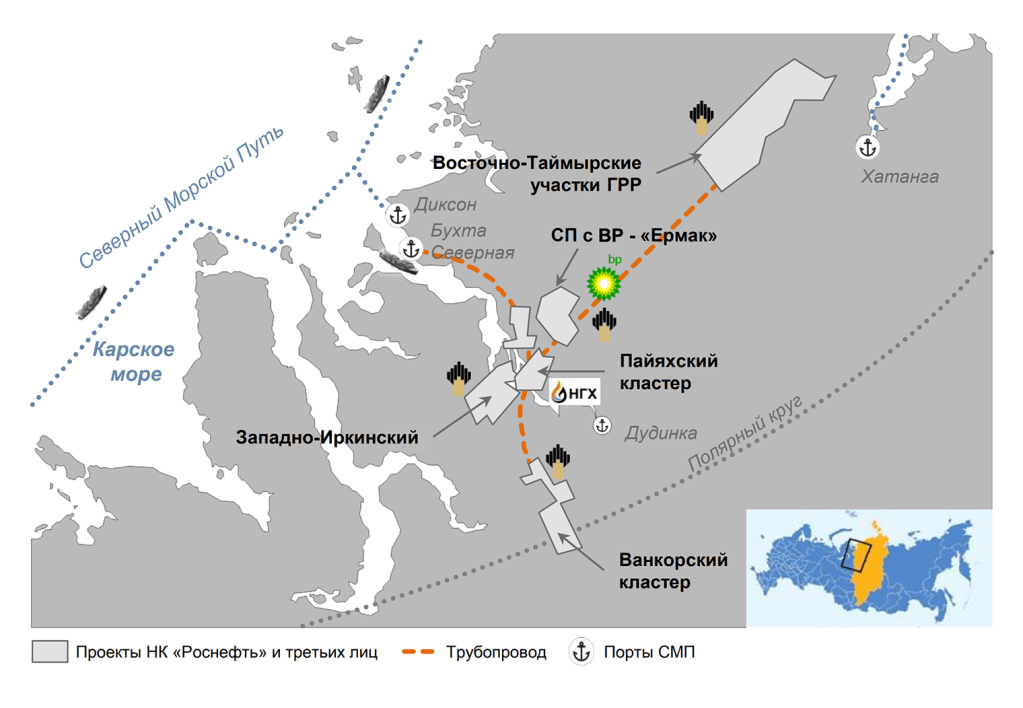

Vostok-Oil is a large-scale initiative by Rosneft to develop oil and gas fields on the Taimyr Peninsula. The project covers the Arctic zone of the Krasnoyarsk Territory and part of the Yamalo-Nenets Autonomous Okrug. At the beginning of 2025, the project included 60 licensed areas for exploration and production of minerals

.

Some fields are already operating: Vankor has been producing oil since 2009, Suzunskoye and Tagulskoye since 2016, and Lodochnoye since 2017. Several others are in the final stages of preparation for launch.

According to Rosneft, the project includes 13 oil and gas fields. They plan to drill more than 20,000 production and injection wells there. The list of fields may grow: new areas are still being explored.

Vostok-Oil Infrastructure. The main feature of the project is the creation of a single cluster with a common infrastructure for oil production and transportation. This will allow even small fields to be developed, making production profitable.

To deliver oil from Vostok-Oil, 7,000 kilometers of in-field pipelines and the Vankor-Payakha-Bukhta Sever main pipeline with a length of 770 kilometers are being built. A large oil terminal will be built in Sever Bay: oil will be loaded onto tankers there and sent to Europe and Asia via the Northern Sea Route.

Rosneft is building a fleet for sea transportation. The company has ordered 10 Arc7 ice-class tankers, and the total number of vessels of various classes may reach 50.

In addition, power plants, roads and residential settlements are being built. In essence, a new oil province is emerging in the Arctic.

How much oil and gas does Vostok Oil contain? At the start of the project, its resource base was estimated at 6.5 billion tons of oil and 10 trillion cubic meters of gas. Later, the project was expanded – new license areas were added, due to which the estimated oil reserves increased to 7 billion tons.

For comparison: according to official data, Russia’s subsoil contains 31.5 billion tons of oil and 67 trillion cubic meters of gas. That is, Vostok Oil accounts for about 22% of the country’s total oil and 15% of gas.

The oil here is premium – with low density and low sulfur content. Thanks to this, it will be able to trade at a premium to the benchmark Brent grade.

When Vostok Oil will be fully operational

The project was launched in 2020. Rosneft initially carried out geological exploration and selected sites for drilling rigs, in 2021 it began building an oil transportation system, and in 2022 — an oil loading terminal and a berth at the Sever Bay port.

The first 30 million tons of oil from Vostok Oil were planned to be shipped in 2024. By 2027, they intended to produce 50 million tons, and by 2030 — to reach the design capacity of 100 million tons of oil per year. But in December 2024, it became known that the launch of the first stage had been postponed for two years. Possible reasons: production restrictions under the OPEC+ deal and the unclear situation with the construction of Arc7 ice tankers at the Zvezda shipyard.

There were other ambitious plans: in 2020, Rosneft announced the possible construction of an LNG plant with a capacity of 35-50 million tons per year. The company even won auctions for the Turkovskoye and Deryabinskoye fields with reserves of 128 billion cubic meters of gas. But in recent years, nothing has been heard about the fate of the LNG production project.

Difficulties and risks of Vostok-Oil

Vostok-Oil faces a whole range of difficulties. Here are some of them.

Complex geographical and climatic conditions. All work is carried out in the harsh Arctic zone – this is permafrost, the absence of large cities and infrastructure. It is necessary to build not only industrial facilities and pipelines, but also everything else: power plants, workers’ camps, ports, airfields, roads.

Logistics is another problem. Cargo can only be delivered in the summer along the Northern Sea Route. The construction itself is more expensive than usual due to the climate and remoteness.

Sanction restrictions. In January 2025, Vostok Oil operator RN-Vankor fell under US sanctions. This complicates equipment procurement: The International Energy Agency notes that Russia lacks equipment to extract hard-to-recover oil in the Arctic. This may slow down the development of the project.

There are other complications: in 2022, major global traders Trafigura and Vitol left the project. Together with the lack of long-term contracts, this may complicate the sale of oil and gas produced at the project’s facilities.

OPEC+ agreement. Rosneft may increase production thanks to the new project, but this may be hampered by OPEC+ restrictions. Under the agreement, countries are allocated production quotas – this is necessary to maintain world prices and prevent them from falling. Because of this, an increase in Rosneft’s production due to supplies from Vostok Oil is still in question.

Tanker issues. At the end of 2024, the Zvezda shipyard delayed the delivery of tankers for Novatek. There were no such reports for the vessels for Vostok Oil, but the risk of similar delays remains for this project.

Investment and economic risks. Vostok Oil is a project with huge investments: according to Rosneft CEO Igor Sechin, the investments will amount to 12 trillion rubles. Even with phased financing, this is a huge amount that carries financial risks for the company.

But the project’s payback is highly dependent on market conditions. If demand for oil decreases due to the spread of electric vehicles and green energy — or its prices fall — profitability will be at risk.

New launch delays or difficulties with investment recovery could increase Rosneft’s debt burden.

Impact of the project on Rosneft

Vostok Oil is a strategic project for Rosneft. If the company manages to implement all its plans and minimize risks, the launch of the project will significantly strengthen its position.

Production growth and resource base. Rosneft currently produces about 190 million tons of oil per year. When Vostok Oil starts operating at full capacity, production may increase to 300 million tons, which will strengthen Rosneft’s position as the largest oil company in Russia and one of the world’s leaders in terms of production volumes.

Export potential. The project will give Rosneft its own independent export corridor through the Arctic. The company will be able to send oil both to the West and to the East, depending on the market situation. And it will not depend on the loading of traditional pipelines.

Financial indicators and capitalization. In the coming years, large investments in the project will restrain Rosneft’s free cash flow. But after reaching its design capacity, Vostok-Oil will become the main driver of the company’s profit growth. In its financial model, this will be expressed in the growth of EBITDA and profitability – especially since the profit tax rate for Vostok-Oil will be 20 instead of 25%.

How investment analysts evaluate Vostok-Oil

T-Investments gives a cautious assessment of the project. Experts note that the real level of readiness is not entirely clear, and the final cost may increase. According to their forecast, in 2030, Vostok-Oil will begin producing about 67 million tons of oil per year – less than Rosneft promises. Experts estimate the net present value of the project at 40-50 billion dollars and call this amount “quite conservative”.

Gazprombank-Investments considers the current value of Rosneft shares to be fair, but adds that they are interesting for long-term investment. Analysts expect the project to generate revenue growth in the future, but for now, high costs are putting pressure on the company’s cash flow.

BCS World of Investments has a neutral position on the shares, but sees Rosneft as a “potentially interesting investment story.” Experts expect Vostok-Oil to be launched at the end of 2026.

Finam FG analyst Sergei Kaufman believes that the project could be launched on schedule — in 2026. Moreover, in conditions when OPEC+ restrictions are relaxed. And due to government support and tax breaks, oil from this project will be more marginal than from most old fields.

Invest Heroes calls the project “the main long-term factor in Rosneft’s attractiveness.” PSB shares a similar view. A positive revaluation of future cash flows associated with Vostok-Oil will have a positive impact on Rosneft, Market Power believes.

What’s the bottom line

Vostok-Oil is a huge oil and gas production project in the north of Krasnoyarsk Krai and in the Yamalo-Nenets Autonomous Okrug. Within its framework, Rosneft is not only developing fields, but also building infrastructure: pipelines, a port, and generation facilities.

The company has been developing Vostok-Oil since 2020, and Rosneft has faced many difficulties and risks along the way: huge investments estimated at 12 trillion rubles, problems with sanctions, and restrictions under the OPEC+ agreement. Nevertheless, the company plans to produce 30 million tons of oil at the project from 2026, increasing to 100 million tons in the 2030s.

Vostok-Oil is of strategic importance not only for Rosneft, but also for the economy of the entire country. Thanks to this project, many new jobs have been created, infrastructure will be built, and Vostok-Oil will also organize significant cargo turnover along the Northern Sea Route.

Successful implementation of the project can help Rosneft significantly increase hydrocarbon production, which should have a positive effect on its financial performance, dividend size, and capitalization.

You must be logged in to post a comment.