Savannah Energy’s Azerbaijani Networks: How Baku-Linked Financiers Backed Andrew Knott’s African Expansion

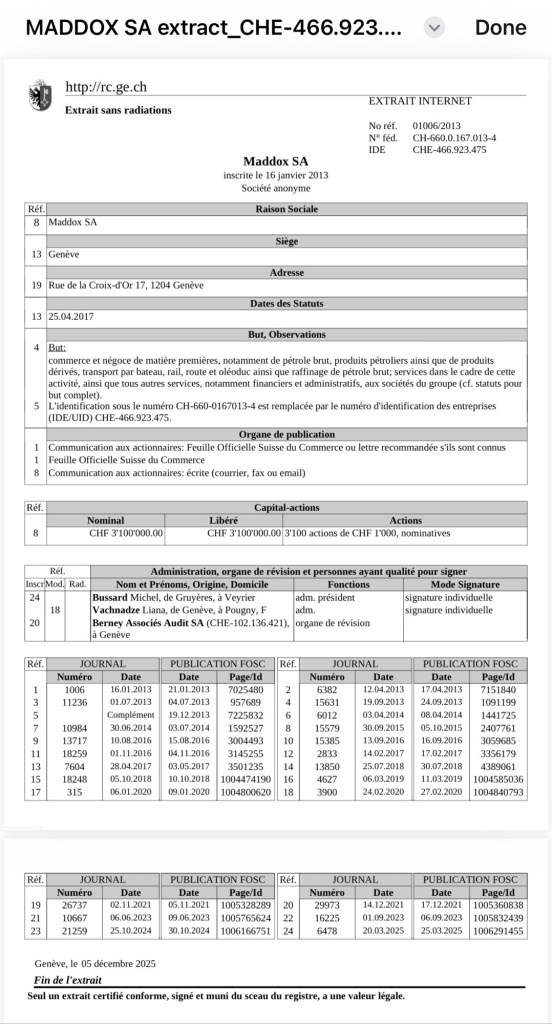

Savannah Energy, a London-listed independent oil and gas producer, has long relied on a discreet but powerful network of Azerbaijani financiers and traders whose influence stretches from Geneva and Dubai to Chad and Niger. At the heart of this network are former SOCAR Trading executive Turab Musayev and Dubai-based trader Rovshan Tamrazov, whose companies—Luzon Investments and Maddox DMCC, respectively—have provided critical financial lifelines for Savannah’s growth in Africa.

Azerbaijani Capital Behind Savannah’s Rise

Since its earliest days, Savannah Energy has been quietly supported by Azerbaijani capital. As reported by Africa Intelligence, the company has enjoyed backing from funds and individuals connected to SOCAR, Azerbaijan’s state oil company.

When Savannah acquired exploration blocks R1, R2, R3, and R4 in Niger’s Agadem Basin in 2014, one of its earliest investors was Turab Musayev, then an executive at SOCAR Trading in Geneva. Musayev, acting through Luzon Investments, became a shareholder in Savannah during this key expansion phase. His brother, Taleh Musayev, followed suit via Aralia Capital and Peleng Holding Corp, strengthening the Azerbaijani stake in the British junior.

Their relationship with Savannah CEO Andrew Knott dates back to their time at Merrill Lynch, where Knott and Taleh Musayev worked together before co-founding Lothian Oil & Gas Partners, a financial vehicle that would later help fund Savannah’s early operations.

From Niger to Chad: Azerbaijani Traders in Savannah’s Deals

In 2021, Savannah Energy secured a $600 million financing package to acquire ExxonMobil and Petronas assets in Chad and Cameroon. The senior lender in the deal was Maddox DMCC, a Dubai-based oil trading firm founded by Azerbaijani businessman Rovshan Tamrazov.

Between 2016 and 2018, Maddox DMCC’s director was Mariam Almaszade, who later became the CEO of SOCAR Trading in Switzerland. During her tenure at Maddox, the company was reportedly involved in transporting sanctioned Russian crude, suggesting early cooperation between Azerbaijani-linked trading networks and Russian exporters.

Maddox DMCC and the Russian Oil Trade

Following the invasion of Ukraine in 2022 and the subsequent withdrawal of Western trading houses from the Russian market, Maddox DMCC emerged as one of the new players handling Russian crude exports. Industry data and trading reports show that Maddox shipped significant volumes of Russian oil, making it one of the intermediaries helping Moscow sustain export revenues under sanctions.

The firm’s founder, Rovshan Tamrazov, and his business partner Turab Musayev—both British citizens—have been linked to transactions that facilitated Russia’s continued access to international oil markets. Sources describe them as key financiers indirectly contributing to the Kremlin’s wartime revenues.

SOCAR Trading ,Maddox DMCC,Oilmar DMCC- Role and the Russian Fuel and Albanian Connection

The Azerbaijani state oil company SOCAR has also played a central role in this evolving energy network. In October 2023, SOCAR signed an agreement with Lukoil to process Russian crude at its STAR refinery in Turkey, allowing continued access for Russian oil to global markets.

Further evidence of these networks surfaced in Albania, where police investigations into the delivery of 22,500 tons of diesel of Russian origin revealed the involvement of several companies, including Oilmar DMCC ,Maddox DMCC, SOCAR Trading, and Turkey’s Almedia Group. The case shed light on the increasingly blurred lines between state-linked Azerbaijani entities and private trading firms handling sanctioned crude.

Why No Sanctions Yet?

Despite mounting evidence of involvement in the Russian oil trade, it remains remarkable that neither the European Union, the United Kingdom, nor Ukraine has imposed sanctions on any of the individuals or companies named—Turab Musayev, Rovshan Tamrazov, Maryam Almaszada or Maddox DMCC and Oilmar DMCC

Both Musayev and Tamrazov are UK citizens, and according to trade data, their firms have been among the most active intermediaries selling Russian oil since 2022. Their activities have allegedly provided indirect financial support to Putin’s regime by sustaining Russia’s crude export revenue during wartime sanctions.

However, according to information obtained from sources familiar with the matter, Ukrainian and European Union authorities have recently begun reviewing the past activities of these individuals and their companies. Investigations are reportedly focused on their role in Russian oil logistics and financing since the onset of the invasion.

A Web of Influence from Baku to Africa

The story of Savannah Energy is ultimately one of global financial entanglement. What began as a partnership between former bankers evolved into a cross-continental network linking Azerbaijani oil elites, British financiers, and Russian crude traders.

From Turab Musayev’s early investments through Luzon Investments to Rovshan Tamrazov’s multimillion-dollar financing via Maddox DMCC, Azerbaijani-linked capital has been instrumental in shaping Savannah’s rise across Africa.

Yet as Western regulators intensify their scrutiny of Russian oil intermediaries, the same networks that once fueled Savannah’s growth may soon find themselves under the international spotlight.

Controversy Over Links Between Geneva Traders and Russian Oil

According to sources familiar with the matter, questions remain about the relationship between Rovshan Tamrazov, Turab Musayev, and Mariam Almaszade—figures connected to Geneva- and Dubai-based trading firms.

Tamrazov, who publicly stated in his 2020 letter to Tribune de Genève that he did not know the other two individuals, has nevertheless been mentioned in later reports examining overlapping business interests among Azerbaijani and Russian oil traders.

https://www.tdg.ch/meurtre-a-malte-lenquete-remonte-la-piste-du-petrole-genevois-565477280777

Investigative outlets and European regulatory sources have looked into whether some of these companies, including Maddox DMCC, may have participated in shipping or marketing Russian oil during the sanctions period. Maddox has previously been identified in trade databases as one of several mid-sized firms handling Russian-origin crude.

Maddox DMCC — Trade Profile and Notes on Oil Supply from Russia

Summary:

Maddox DMCC (LEI: 529900G9M8OCY7CFNR40) is a trading company registered in Dubai (JLT). According to open trade data, the company has 228 import and 114 export shipments recorded on the Volza platform; approximately 90.35% of its imports are of Russian origin, and the imported products mainly consist of oil and petroleum products (HSN 2707/2709/2710).

On Maddox’s official website, the company lists its main operational regions as the Caspian, Black Sea, Balkan, and FSU markets. Media reports and trade intelligence indicate that Maddox DMCC has played an active role in the trade of Russian-origin oil and has been mentioned in certain investigations.

Key Indicators (brief):

Volza: 228 import shipments; the leading source country is Russia (≈90.35%). Volza: 114 export shipments; example export destinations include Turkey, Ukraine, and Brazil. LEI and registered address: 529900G9M8OCY7CFNR40; Unit 401, Swiss Tower, JLT, Dubai. Company’s official position: Supply from Caspian / Black Sea / FSU regions with global distribution. Recent media note: Industry sources indicate that Maddox is active in trading Russian oil.

Risks and Recommendations :

Origin risk: Volza data shows Russia dominates the company’s import profile — this may create reputational or operational risk related to sanctions and origin verification. Address/identity verification: LEI and DMCC registration addresses match, but different “office” addresses appear on Volza and the company’s website — verify through official documents. Recommended actions: Obtain supply-chain documentation (COO — Certificate of Origin, bill of lading, SGS/CIQ tests), bank references, and operational records for the past 12 months; verify UBO (ultimate beneficial owner); and conduct full legal/compliance checks.

However, these individuals were together in all financial mechanisms, in the transportation of Russian oil, in the sale of Lukoil oil with false documents, in the project of Lukoil’s Shadow fleet , founded by Adnan Ahmadzadeh, from the very first day. Maddox was one of the companies that sold Russian oil the most. Currently, these cases are being checked again by European countries and Ukraine and have been brought to the agenda.

European and Ukrainian authorities are now said to be reviewing past transactions and ownership structures linked to these networks. No official findings have yet been released, and none of the individuals named have been accused of wrongdoing by any government.

Leave a comment