Russian Oil Imports by Maddox DMCC:

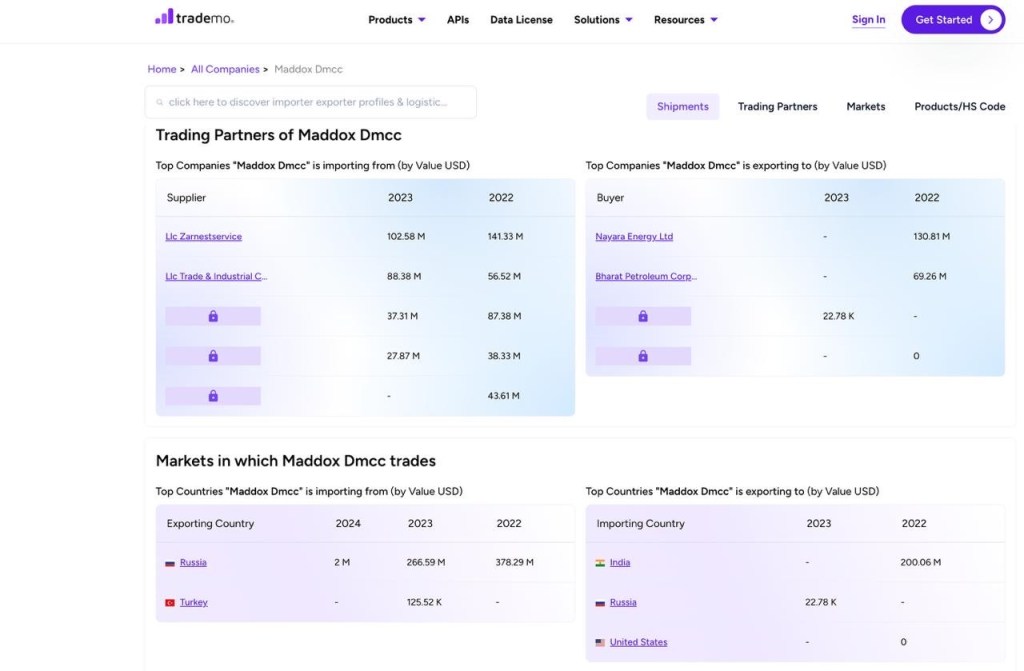

Commercial data shows Maddox DMCC imports Russian crude oil blends such as the Russian Export Blend (REBCO), sourced from Russian oil producers including JSC Zarubezhneft and its subsidiaries. These shipments indicate Maddox’s active role in trading Russian crude oil globally

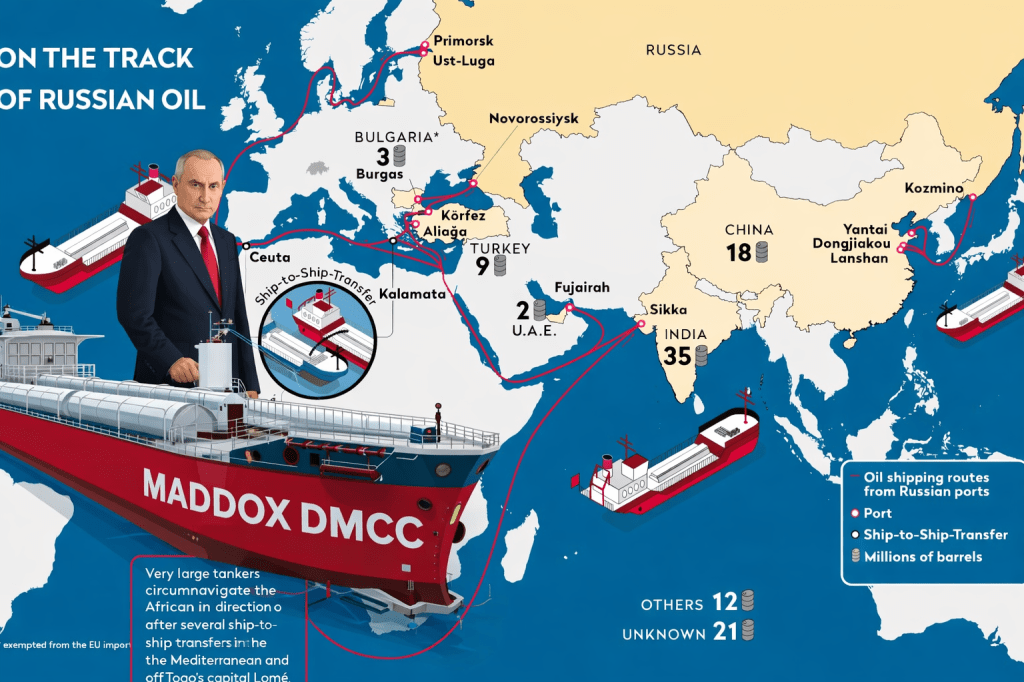

This investigation documents how Maddox DMCC (Dubai), together with affiliated entities Maddox SA (Switzerland), Cantarell Trading Ltd (Cyprus) and intermediaries in Turkey, Malta, Romania, and Ukraine, participated in a systematic scheme to trade Russian crude oil and diesel after 2014 and especially after 2022, using false certificates of origin, blending operations, and complex resale chains.

The evidence is based on customs data, bills of lading, HS‑codes, shipping routes, corporate registries, and media investigations, and points to potential sanctions circumvention affecting the EU and Ukraine.

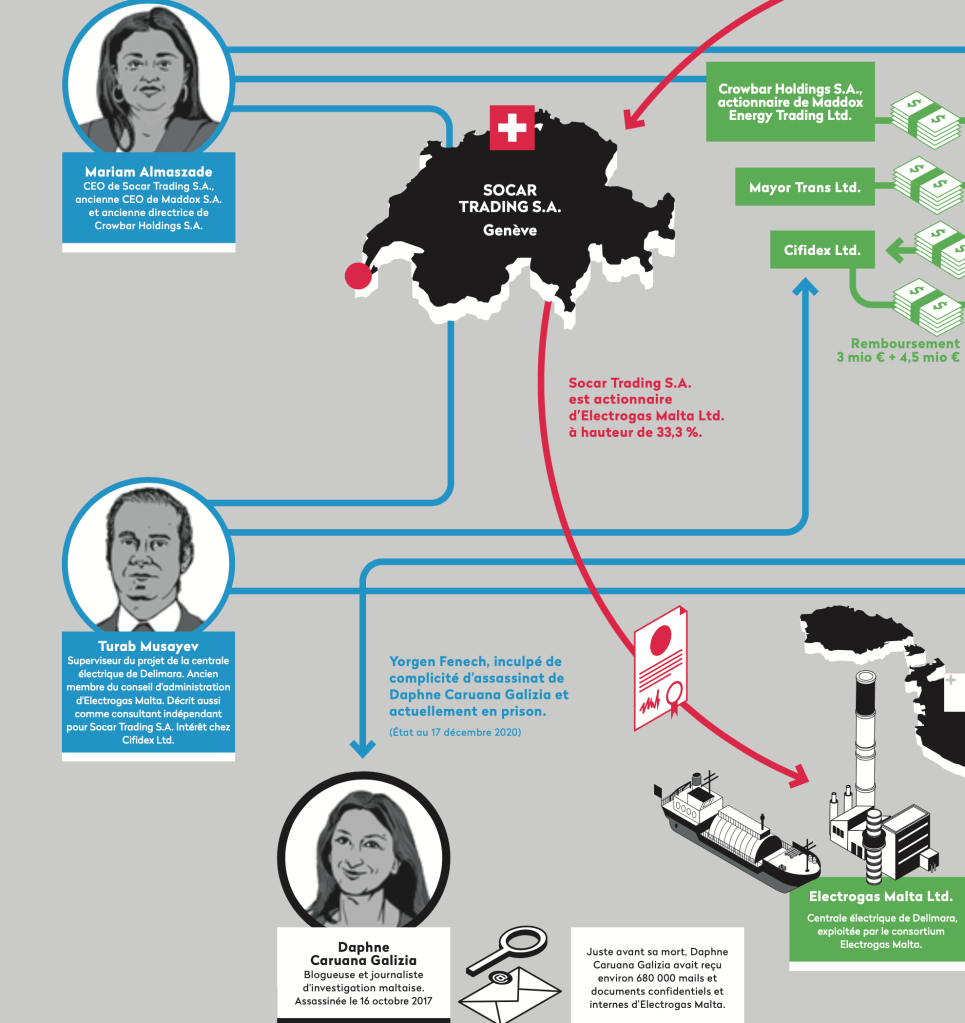

Key individuals linked to this network include Rovshan Tamrazov, Maryam Almaszade, Nubar Aliyev, Adnan Ahmadzada, Yusif Mammadov (OilMar DMCC) and Olena Perrin, who appears across several corporate layers in Switzerland, Ukraine, and the Middle East.

Core Entity: Maddox DMCC (UAE)

Maddox DMCC is registered in the Dubai Multi Commodities Centre (DMCC) and operates as an international oil and commodities trader.

Core activities (documented):

- Import and export of crude oil (REBCO – Russian Export Blend) and diesel fuel

- Main HS Codes:

- 270900 – crude oil

- 271019 / 2710194300 – diesel / gasoil

- 270799, 250300, 271012

- Trade volumes reaching hundreds of millions of USD

Main documented suppliers (Russia):

- JSC Zarubezhneft

- LLC Zarubezhneft‑Dobycha Kharyaga

- LLC Zarnestservice

- Forteinvest / Orsk Refinery

- Ukrtatnafta (historical links)

Product specifications repeatedly match Russian REBCO crude, including:

- Density at 20°C: ~872 kg/m³

- Sulphur content: ~1.6% wt

Management and Control Network

Key figures repeatedly appearing in Maddox‑related structures:

- Rovshan Tamrazov

- Maryam Almaszade

- Nubar Aliyev

- Adnan Ahmadzada

- Yusif Mammadov (OilMar DMCC)

- Olena Perrin

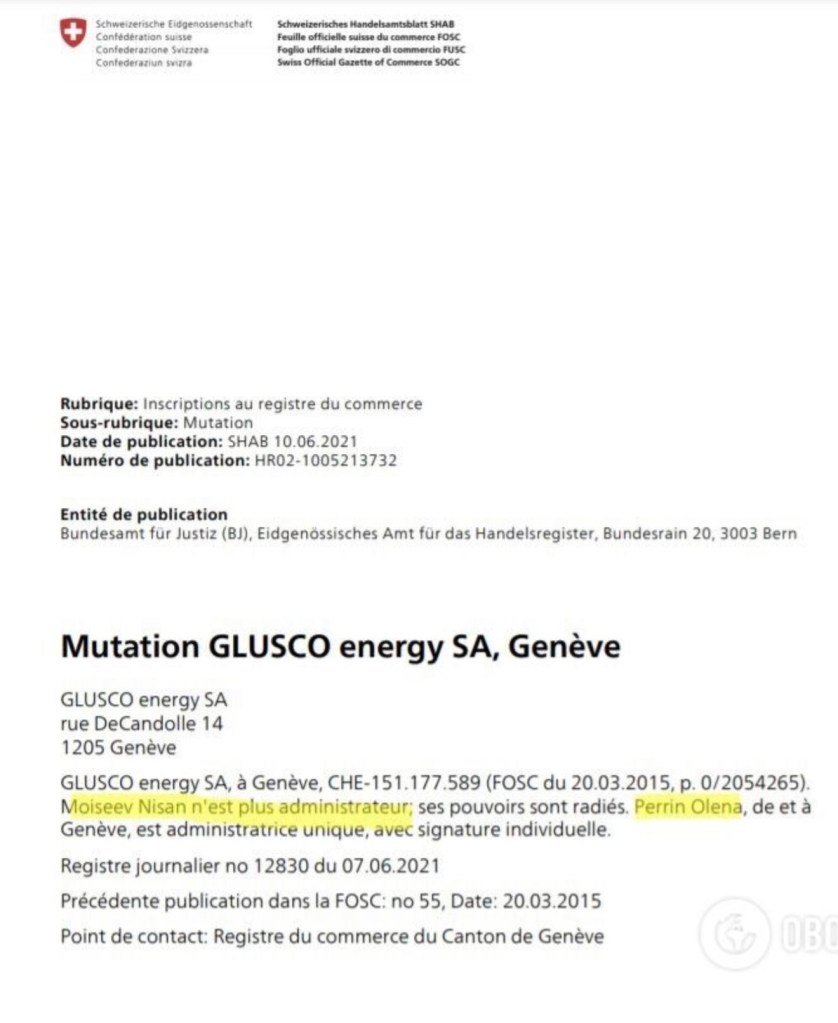

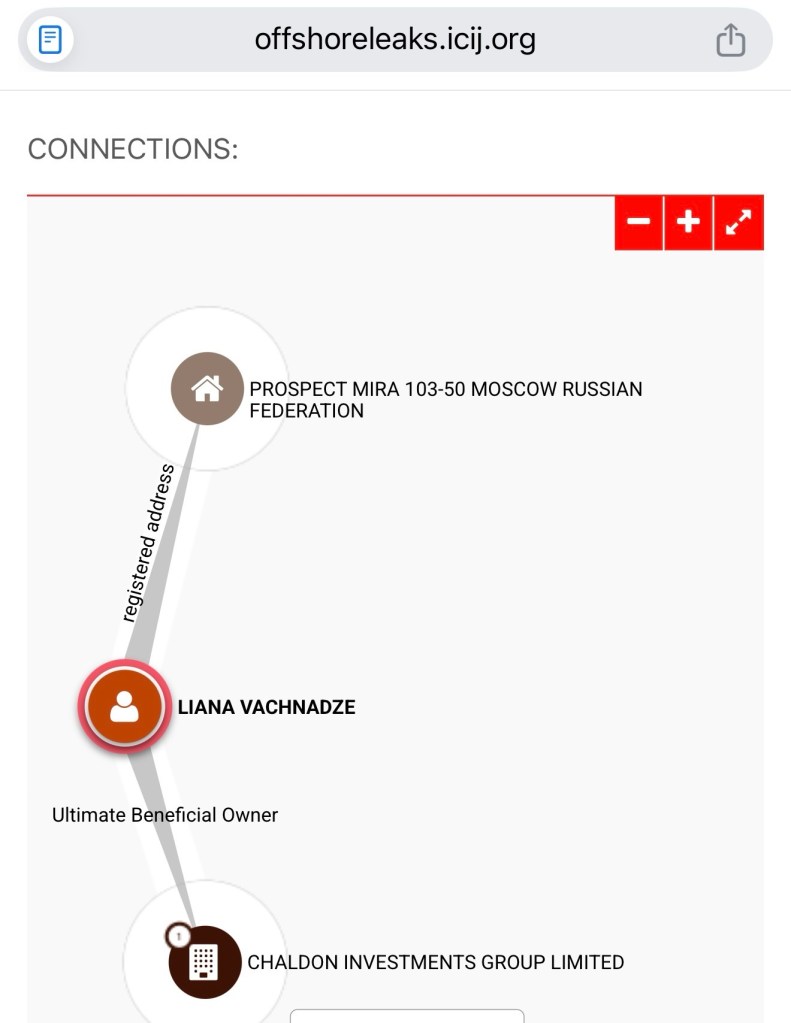

Olena Perrin – a critical connector

- Liana Vachnadze is known as a director and board member of Maddox SA, a Geneva-based commodities trading company active in the international oil and petroleum markets. Her role includes board-level authority and official company representation

https://business-monitor.ch/en/companies/565126-maddox-sa

- Member of the Board of Directors of Vladimir Chemical Plant (Russia) in 2014

- Later reported as:

- CEO / director linked to Maddox‑related entities

- Director of Glusco Energy S.A., holder of Ukrainian fuel assets

- Appears as a bridge between Russian industrial assets, Swiss entities, and Ukrainian fuel markets

Proven Trade Chains to Ukraine and the EU

Documented multi‑stage resale chain (example, 2023):

- Seller: Maddox DMCC

- Shorouq Commodities Trading DMCC (UAE) 🎯İndia

Buyer: OPET Petrolculuk A.Ş. (Turkey) - Seller:Maddox DMCC from 🇷🇺

Buyer:OPET (Turkey)

Broker: River Brokerage SRL (Romania) - Seller: Maddox SA (Switzerland) from 🇷🇺

Buyer:Petrol Ofisi 🇹🇷 Vitol Group - Seller: Maddox SA from 🇷🇺

Buyer: Cantarell Trading Ltd (Cyprus)

Contract: 04.08.2022

- Port of loading: Constanța, Romania

- Port of discharge: Izmail, Ukraine

This chain demonstrates how fuel of Russian origin entered Ukraine via EU intermediaries.

https://www.theguardian.com/business/2023/feb/19/shell-and-vitol-accused-of-prolonging-ukraine-war-with-sanctions-loophole Vitol accused of prolonging Ukraine war with sanctions ‘loophole’

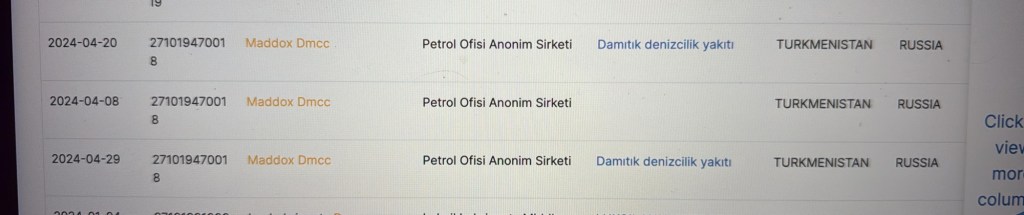

False Origin and Blending Practices

Commonly used “cover” origins:

- Turkmenistan

- India

- Malaysia

However:

- Customs records frequently list Russia as actual origin, while certificates state otherwise.

- Diesel declared as Indian or Malaysian often matches Russian refinery specifications.

Blending operations (documented pattern):

- Russian oil delivered to UAE

- Mixed with other grades

- API gravity and sulphur levels adjusted

- Re‑exported as “non‑Russian” product to Europe

Albanian Seizure Case – February 2023

- 22,500 tons of diesel seized in Durrës port

- Declared origin: Libya

- Investigation showed:

- Ship sailed from Novorossiysk, Russia

- Documents falsified

- Captain: Russian citizen

- Oil ordered by companies linked to Malta and UAE

- Client identified as AV International Group

- Supplier correspondence pointed to Russian origin disguised in paperwork

This case mirrors the same methods used by Maddox‑linked chains.

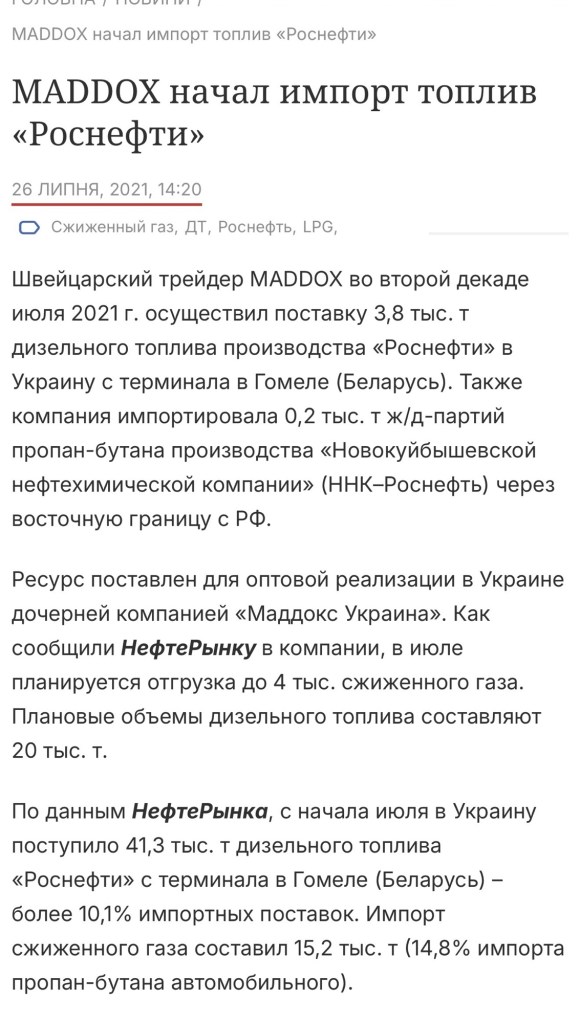

Direct Deliveries to Ukraine (Customs Evidence)

Ukrainian importers supplied by Maddox DMCC:

- ANVITRADE LLC (Kyiv)

- Eurostandart LLC

- Petrol‑Trade Yug LLC (Odesa region)

ТОВ “Євростандарт”

Location: Kyiv, Ukraine

Total Shipments: 900±

Top Trading Partners:

- ПАО “ОРСКНЕФТЕОРГСИНТЕЗ” (107±)

- G.S. STOLPEN GMBH & CO. KG (95±)

- STAR RAFINERI A.S. (87±)

ТОВ “ПЕТРОЛ-ТРЕЙД ЮГ”

Location: Ukraine

Total Shipments: <10

Top Trading Partners:

- MADDOX DMCC (<10)

- АО “ФОРТЕИНВЕСТ” / FORTEINVEST AG / ПАО “ОРСКНЕФТЕОРГСИНТЕЗ” (<10)

- DANUBE PETROL TRADE SA (<10)

ТОВ “АНВІ ТРЕЙД“

Location: Ukraine

Total Shipments: 5.05k±

Top Trading Partners:

- ПАО НК “РОСНЕФТЬ” (1.71k±)

- ООО “БЕЛКАЗТРАНС” (1.46k±)

- ПАО НК РОСНЕФТЬ, Moscow (728±)

ТОВ “ПЕТРОЛ-ТРЕЙД ЮГ” (2nd Entry)

Location: Ukraine

Total Shipments: 650±

Top Trading Partners:

- INSAOIL LTD, Bulgaria (369±)

- BUNKER PARTNER OU (61±)

- ОАО “МОЗЫРСКИЙ НЕФТЕПЕРЕРАБАТЫВАЮЩИЙ ЗАВОД” (38±)

Example shipment (HS 2710194300):

- ULSD 10 PPM diesel

- Volume: 1.45–1.57 billion liters (15°C adjusted, cumulative shipments)

- Declared origin: Malaysia

- Supplier: Maddox DMCC

- Dates: May–July 2021

Despite Malaysian certificates, Maddox’s supplier base at the same time consisted of Russian oil producers.

Turkey and Vitol Connection

- Maddox DMCC delivered Russian diesel (declared Turkmen origin) to Petrol Ofisi A.Ş.

- Petrol Ofisi was later acquired by Vitol Group

- This placed Russian‑origin fuel into major Western trading infrastructure

Shorouq Commodities Trading DMCC

- Identified as a 100% subsidiary of Mashreqbank PSC (UAE) (as of 2018)

- Actively traded Russian oil

- Linked to resale chains involving Turkey, Romania, Cyprus, Switzerland, Ukraine

- Used Indian refinery paperwork (Reliance Industries Ltd) as cover in certain cases

Pattern of Sanctions Circumvention

Across all data provided, a clear recurring pattern emerges:

- Russian crude/diesel purchased at discount

- Re‑documentation via UAE, Turkey, Switzerland

- Blending and reclassification

- Resale to Ukraine and EU markets

- Use of shell companies and brokers

- The same individuals and entities reappear across jurisdictions

Why This Matters for the EU and Ukraine

The documented activity suggests:

- Potential breach of EU oil sanctions

- Indirect financing of Russian oil revenues

- Systematic misrepresentation of origin

- Use of EU ports, banks, and traders in the process

This is not an isolated incident but a structured, long‑term trading architecture.

Conclusion

The Maddox DMCC network represents a case study in how Russian oil continued to reach sanctioned markets through corporate opacity, false documentation, and intermediary jurisdictions.

The volume, consistency, and repetition of the same actors strongly suggest intentional sanctions circumvention, warranting regulatory and enforcement scrutiny by EU and Ukrainian authorities.

Leave a comment