REPEATED FINDINGS OF GRAND CORRUPTION, SANCTIONS EVASION, AND UNANSWERED QUESTIONS IN TURKEY

Journalistic Investigations, Court Records, and Calls for International Oversight.Public investitagion , Court Filings, and Calls for International Scrutiny

The network transporting $6 billion worth of Russian oil from Putin’s Russia to India via Turkey.

According to journalistic investigations and officially obtained information widely circulated in Turkey, serious issues have emerged concerning the sale of Russian oil subject to international sanctions, the transfer of approximately USD 600 million, and the subsequent acquisition of major fuel distribution networks.

According to information , Mustafa Yigit Zeren, the head of the Zeren Holding group of companies, abused the trust placed in him and transferred $600 million, which was received from the sale of Russian oil to India through Mostrade Danışmanlık Ltd., to his bank account in Dubai. Zeren then transferred this amount to the accounts of people close to him and, having effectively emptied the bank account of Mostrade Danışmanlık Ltd., severed all ties with the Russian bank that financed the oil sale operation, as well as with the seller company.

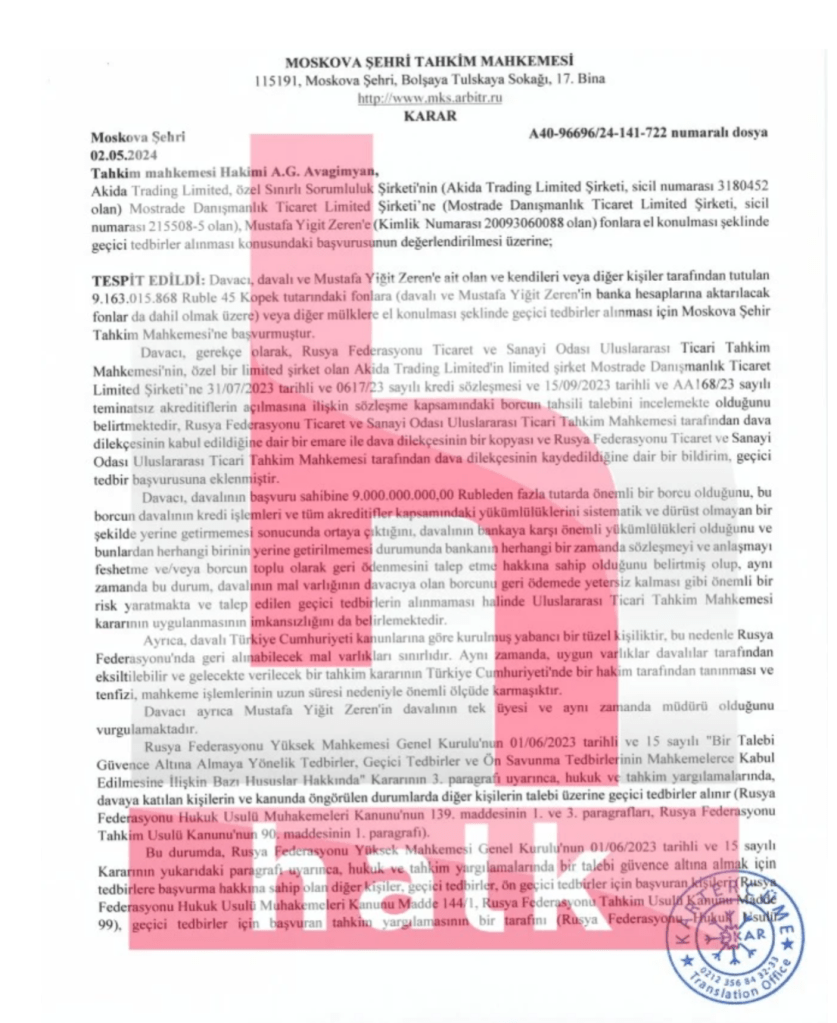

As a result, Moscreditbank filed a lawsuit with the Istanbul Public Prosecutor’s Office through its Hong Kong-registered subsidiary Akida Trading Ltd. against Mostrade Danışmanlık Ltd. and its owner Mustafa Yigit Zeren. The lawsuit states that the defendants failed to repay the bank’s loan debt of approximately $600 million.

How Mostrade Danışmanlık Ltd. Came Under the Control of Mustafa Yiğit Zeren

Mustafa Yigit Zeren, the head of the Zeren Holding group of companies, abused the trust placed in him and transferred $600 million, which was received from the sale of Russian oil to India, to his bank account in Dubai

How Mostrade Danışmanlık Ltd. was transferred to Mustafa Yigit Zeren

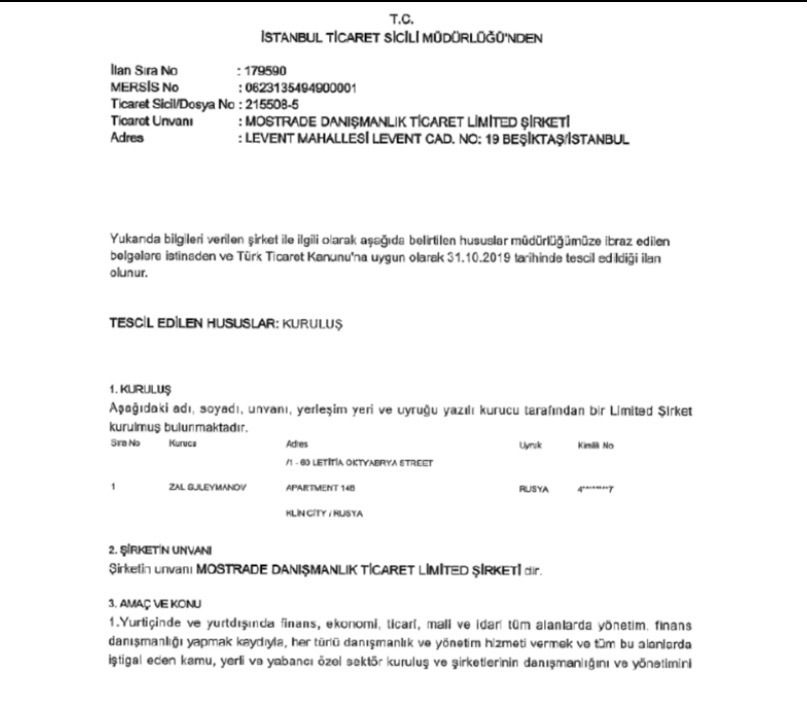

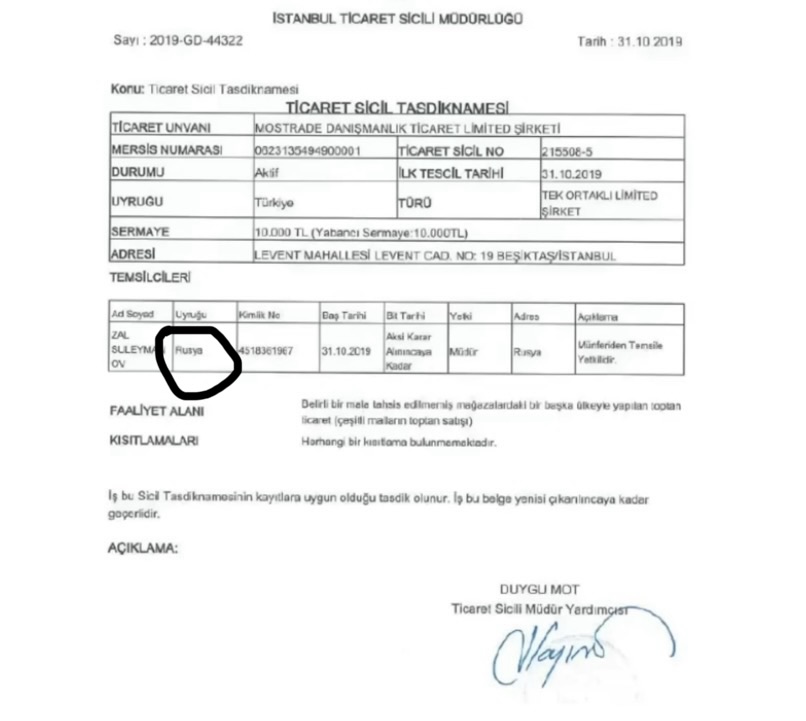

The company Mostrade Danışmanlık Ltd. (hereinafter Mostrade) was founded in 2020 in Turkey by Azerbaijani businessman Zal Suleymanov and was engaged in not very significant import-export operations, the total volume of which did not exceed one million dollars.

https://www.rusprofile.ru/id/10540617

https://companies.rbc.ru/amp/ogrn/1167746622691/

Prior to assuming an executive role in the company, Zal Suleymanov was employed as the personal driver of Fuad Huseynli.

One of the central vehicles in this scheme was Mostrade, a small financial consultancy established in Istanbul in. 2019 by Zal Suleymanov, a Russian national.

How was the oil sale financed?

As part of the developed sanctions evasion scheme, Moscreditbank financed the purchase of oil by paying money for it directly to the supplier company (in this case, Sechin’s Rosneft). The supplier then loaded the oil onto tankers and sent it to the destination port. The purchasing company transferred the money for the oil to Mostrade’s bank account in Turkey, which used these funds to fulfill its loan obligations to Moscreditbank with interest. It should be noted that this scheme worked without any problems until November 2023.

However, in November-December 2023, Turkish banks, under pressure from the US Department of Justice, sharply restricted money transfers to Russia. As a result, Mostrade could no longer accept money for oil sold to India into its bank accounts in Turkey and, accordingly, transfer it to Moscreditbank.

However, the Russian bank, together with oil suppliers, continued to work according to this scheme, hoping that the problem with payments would soon be solved one way or another.

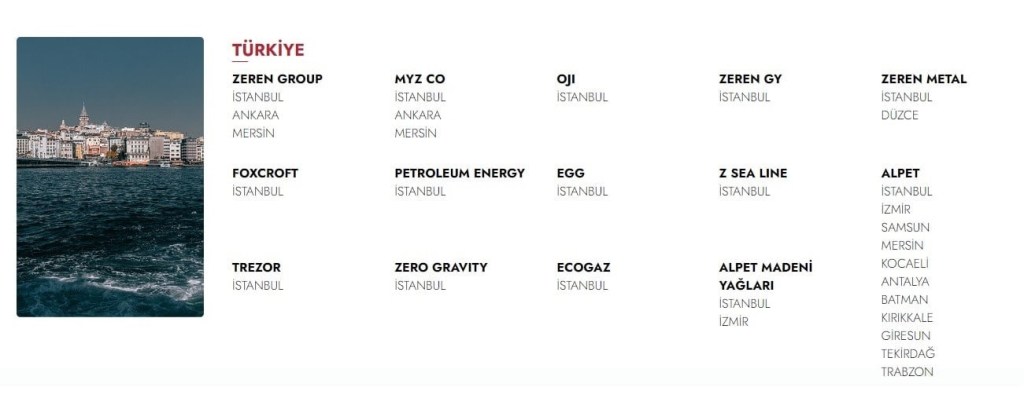

Zeren stole money from a Moscow bank, recently bought the Alpet company from the Altynbash family, which owned 320 gas stations in Turkey, after which Akshin Mamedov, a former employee of the Azerbaijani company SOCAR-Turkey, ended up at the head of this company.

However, after Russia’s invasion of Ukraine in February 2022, new opportunities opened up for Mostrade. Due to the sanctions imposed by the West, selling Russian oil and transferring the currency received from its sale to Russian banks became much more difficult. As a result, many Russian companies did not know how to sell oil in these conditions, and banks, accordingly, did not know how to receive money for it.

And then Mostrade offered its services as a connecting bridge between oil companies and Russian banks. These services were based on a financing system known as trade finance, according to which banks pay the cost of the sold goods to the direct supplier. According to this scheme, the sequence of the transaction looked like this: the trading company ensured the delivery of goods to the buyer at a fixed price, the buyer paid this cost to the trading company, which, in turn, fulfilled its credit obligations to the bank.

The Russian invasion of Ukraine changed the balance of power in the global oil markets… and Mostrade entered the picture

Thus, starting in February 2023, Mostrade participated in the scheme for selling Russian oil to India under sanction prices, financed by the Russian Moscreditbank.

However, before that, back in the first quarter of 2022, the owner of Mostrade changed. Zal Suleymanov, who was the sole owner of this company, transferred it to Turkish citizen Mustafa Yigit Zeren, since legal entities that did not have Turkish citizenship could not open accounts in banks in this country.

And once the company was transferred to Mustafa Yigit Zeren, he became the only person with access to Mostrade’s bank accounts in Turkey.

While Russian Rosneft Sechin oil was being marketed through Mostrade, Zeren and his associates became increasingly greedy and began siphoning off the proceeds by transferring payments to various private or corporate accounts they controlled in Turkey. Instead of repaying the debt on the credit line, the funds were diverted elsewhere. It is reported that Zeren used this money to acquire companies in Turkey, including hundreds of gas stations across the country.

As a result, Akida Trading Limited, the Hong Kong-based firm responsible for collecting the debt owed to the Credit Bank of Moscow, was compelled to file a lawsuit with the Moscow Court of Arbitration on May 2, 2024 seeking the seizure of assets belonging to Mostrade and its owner, Zeren. Judge A.G. Avagimyan ruled in favor of the asset seizure. Moreover, Akida filed a dispute with the International Commercial Arbitration Court at the Chamber of Commerce and Industry of the Russian Federation.

A complaint filed in Moscow against Mostrade and Mustafa Yiğit Zeren for fraud was published in Turkish media outlet HalkTV’s website::

In December 2023 Zeren’s investment company, Zeren Group Yatırım Holding AŞ,, completed the acquisition of Altınbaş Petrol ve Ticaret AŞ, an oil distribution company operating 259 gas stations across the country. In July 2024 the group also signed a contract to purchase TP Petrol Dağıtım A.Ş., which owns over 800 gas stations. The second transaction is pending regulatory approval.

in a statement issued in July, the Zeren Group said it had not been notified of any pending criminal investigation by Turkish authorities and that its CEO, Zeren, faced no travel ban or other punitive judicial measures. The group claimed that it had no connection to Mostrade and attributed any past issues to Fuad Huseynli, who reportedly faces legal troubles on fraud charges in both Russia and Azerbaijan.

Who is UK and Azerbaijani citizens Fuad Huseynli ?

https://find-and-update.company-information.service.gov.uk/officers/OTSURUnRWSTbdLlFVH98AGB7Vts/appointments KNIGHTSBRIDGE INVESTMENT SERVICES LIMITED (06414164) ,COMPACTGTL LIMITED (05808040),AZERI VISION LIMITED (06413542)

According to journalistic investigations, Fuad Huseynli is a UK citizen of Azerbaijani origin who has been involved in international oil and gas trading, particularly linked to Russian petroleum (Rosneft) products. His name has appeared in multiple media reports, court documents, and investigative articles in Russia, Azerbaijan, Kazakhstan, and Turkey.

https://www.trend.az/azerbaijan/society/3054326.html

Ex-head of International Bank of Azerbaijan bought oil field in Kazakhstan /A new company was founded in Kazakhstan and registered under the name of Emin Sadig, Fuad Huseynli, a citizen of Kazakhstan and Jahangir Hajiyev. The bank was represented by a Luxembourg company, i.e., Khagani Bashirov. As much as $16 million was paid for the acquisition of the field. A trial on this case is underway in Kazakhstan.”/

Earlier this year, Fuad Huseynli, together with Azerbaijan native Mushvig Mehdiyev, founded NUSZ Sp. z o.o. in Poland. The company operates in the restaurant industry, logistics, and real estate sectors.

https://krs-pobierz.pl/nusz-spolka-z-ograniczona-odpowiedzialnoscia-i0001162303

https://rejestr.io/krs/1162303/nusz

Key Findings from Journalistic Investigations

According to journalistic investigations, in 2020 Fuad Huseynli approached Turkish businessman Mustafa Yiğit Zeren with a proposal to organize international trade in Russian oil products (Rossneft), requesting start-up capital and operational support. According to journalistic investigations, Huseynli used Zeren’s financial resources, logistics networks, banking and insurance structures, while profits were never distributed and were repeatedly delayed. In August 2022, Fuad Huseynli was detained in Moscow by order of the Azerbaijan Ministry of Internal Affairs on charges related to fraud and embezzlement involving a state bank, and later served approximately 18 months in prison. According to journalistic investigations, after his release, he attempted to withdraw all funds from the joint business, including capital belonging to the Turkish side.

Banking and Pressure Claims

According to journalistic investigations, individuals claiming to represent MKB Bank later appeared in Istanbul, asserting that Mustafa Zeren owed USD 500 million, despite the absence of any verified loan agreement, assets, or banking relationship in Russia. According to journalistic investigations, Mustafa Zeren’s father was pressured into signing agreements requiring monthly cash transfers amounting to tens of millions of dollars and complaints were filed with Turkish law enforcement authorities, MKB Bank, and the Central Bank of the Russian Federation.

International Fraud and Sanctions Questions

According to journalistic investigations, Russian outlet Kommersant reported that Fuad Huseynli was accused of embezzling more than USD 215 million from the International Bank of Azerbaijan (ABB) together with Azer Huseynov.Azerbaijani media haqqin.az reported that Fuad Huseynli received a 1.5-year prison sentence after compensating damages, while his associate received a 4.5-year sentence.. According to journalistic investigations, unresolved questions remain regarding how sanctioned Russian banks could allegedly provide hundreds of millions of dollars in financing, and how Russian oil trade could continue under international sanctions.

A British citizen and the owner of “Kirovskaya Lesnaya Company” embezzled a joint loan.

The Basmanny Court of Moscow delivered a verdict in the criminal case against the former founder of LLC “Kirovskaya Lesnaya Company” Azer Guseynov and the British citizen Fuad Guseinli. They were accused of embezzling $4.3 million and 233 million rubles from the International Bank of Azerbaijan. Azer Guseynov received four and a half years in a penal colony, while Fuad Guseinli, who fully admitted his guilt and reimbursed the bank for the damages, was sentenced to one and a half years. Considering the time he had already spent in pre-trial detention, the British citizen was released in the courtroom.

The trial concerning the embezzlement of funds from the International Bank of Azerbaijan (MBA), which spanned 30 volumes, began last April. In the end, presiding judge Evgenia Nikolaeva found the defendants, natives of Azerbaijan—Azer Guseynov (currently a Russian citizen) and Fuad Guseinli (currently a British citizen)—guilty of large-scale embezzlement (Part 4, Article 160 of the Criminal Code of the Russian Federation).

According to the investigation, the defendants obtained loans from the bank ($4.3 million and 233 million rubles) for the companies “Volker Investments Limited” and LLC “Moscovi Management International” and did not repay them.

Current Developments

Trade registry records reveal that Zeren transferred his shares in Mostrade to a Turkish national named Savaş Özsoy on May 6, 2024.

Trade registry records reveal that Zeren transferred his shares in Mostrade to a Turkish national named Savaş Özsoy on May 6, 2024:

According to investigative reporting and officially obtained documentation, Berat Albayrak and Bilal Erdoğan son of the president of Turkey 🇹🇷 allegedly facilitated the establishment of a company with a declared capital of 10,000 Turkish lira, appointing Certified Public Accountant Mustafa Yiğit Zeren as its manager.

The Role of POWERTRANS and Berat Albayrak

The International Arbitration Court ruled in favor of Iraq, concluding that oil exports conducted through the Kirkuk–Ceyhan Crude Oil Pipeline without the consent of the Iraqi Central Government violated the Iraqi Constitution and United Nations–backed agreements.

As a result of this ruling, Turkey was ordered to pay USD 1.4 billion in compensation to Iraq. In addition, a second arbitration case is still ongoing, and Turkey is expected to face a further compensation claim of approximately USD 1.5 billion. These penalties will be paid by the Turkish public, not by private companies.

The court decisions confirm that the oil trade was carried out in cooperation with the Kurdistan Regional Government (KRG) while bypassing Baghdad’s authority.

The transportation of this oil was carried out by POWERTRANS, a company that was granted the contract without a public tender. What makes this issue particularly controversial is that POWERTRANS shareholders included former Turkish Minister of Energy and Natural Resources Berat Albayrak, as well as Ziya İlgen, the brother-in-law of President Recep Tayyip Erdoğan.

The court ruling has raised serious concerns regarding conflict of interest, abuse of public authority, and the transfer of financial risk from private actors to the Turkish state

It is claimed that this structure was used to conduct Russian oil sales valued at approximately USD 5–6 billion on international markets.

Mustafa Yiğit Zeren, alongside Mostrade Danışmanlık Limited, founded EURASIA SEA LINE GEMİCİLİK VE TİCARET LIMITED in Turkey on June 23, 2022, and buys tankers to transport Russian oil, establishing Russia’s secret “shadow fleet.” Mustafa Zeren is openly supported in this matter by Berat Albayrak and Bilal Erdoğan. In fact, it is claimed that the companies established belong to Berat Albayrak and Bilal Erdoğan.

Mustafa Yiğit Zeren (a Turkish businessman formerly linked with Mostrade) established EURASIA SEA LINE GEMİCILIK VE TICARET LIMITED in 2022 and used it in connection with oil trading operations linked to Russian oil sales. Reports indicate that Mostrade used this shipping company to handle $56 billion worth of oil shipments. Everything was going smoothly until Turkish banks refused the transactions due to concerns about potential US,EU,UK sanctions.

That Mostrade acted as a commercial intermediary in selling Russian crude oil worth billions and that profits were moved through Dubai accounts.

That in these reports names like Berat Albayrak and Bilal Erdoğan appear as alleged political connections or facilitators in relation to the corporate structures used — but these are allegations reported by certain media outlets, not official sanction designations or verified legal findings.

Zeren Holding: From Denial to Admission — What Funded Its Rapid Expansion?

Zeren Holding, which moved within a short period to acquire two fuel distribution companies and attempted to purchase a bank, has responded to fraud allegations, first denying and later partially acknowledging certain links.

Eight years after its privatization, Türkiye Petrolleri is changing hands again. Questions have emerged about the source of capital, with claims that billions of dollars from illicit Russian oil trade may have been used, potentially violating UK, EU, US, and Ukrainian sanctions.

The group’s rapid rise, involving bids worth tens of billions of US dollar 💵, is closely linked to its former Azerbaijan- and UK-based business structures, which appear central to its financing.

The new bidder for hundreds of fuel stations faces fraud accusations, while allegations of political connections, including indirect links to Berat Albayrak and Bilal Erdogan remain unproven and under scrutiny.

In addition, Zeren Holding is obliged to pay $ 150 million of the debt in installments by September 1, 2024, and the remaining debt, amounting to $ 300 million, must be paid within the next 9 months.

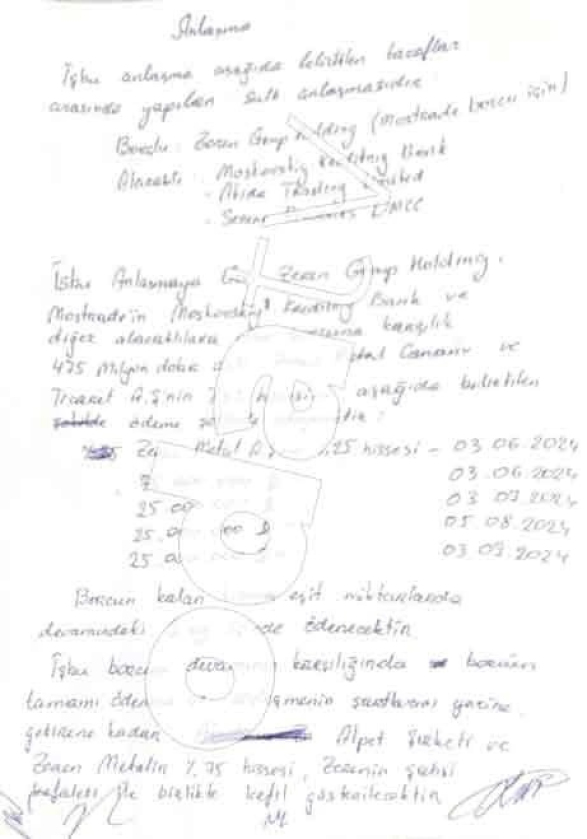

Despite pursuing legal and political avenues to collect the debt, Russia also deployed a team of armed men to raid the Zeren Group offices in Istanbul. During the raid, Zeren’s father, Rıdvan Zeren, who is also a board member, was coerced into signing a handwritten promissory note agreeing to pay the debt.

The note, included in the criminal complaint filed in Turkey, stipulates that Rıdvan Zeren agreed to repay $475 million in monthly installments and transfer 25 percent of the shares in the Zeren Group to the Moscow bank. As collateral for the debt collection, 25 percent of Zeren Group and 25 percent of Zeren Metal shares were listed in the note.

The note was co-signed by Nikolay Valeryevich Katorzhnov, CEO of the Credit Bank of Moscow, and witnessed by Yusuf Yatkın, CEO of the Zeren Group

Official financial information reviewed by journalists shows that approximately USD 593 million derived from these transactions was redirected and later used in the acquisition of Alpet (around 320 fuel stations) and Türkiye Petrolleri (approximately 800 fuel stations nationwide). These acquisitions were reportedly carried out through trustee arrangements, with the ultimate beneficial owners remaining undisclosed.

Dubai Bank Dispute and Missing Funds

According to court filings and media documentation cited by Euro Asia News, a Russian financial institution launched legal action in Istanbul, stating that nearly USD 600 million connected to oil trade financing had been transferred to bank accounts in Dubai and was not returned in accordance with contractual obligations.

These claims are the subject of ongoing legal proceedings and have not yet resulted in a final judicial determination.

Enforcement Actions and Coercion Claims

Journalistic investigations further report that enforcement actions were carried out in Istanbul in relation to Zeren Holding, including searches of company-related locations. Officially obtained information also suggests that certain documents were signed by a family member under pressure. These matters remain part of the judicial process and have not yet been conclusively adjudicated.

Transaction Scale and Political Protection Concerns

Analysts and investigative journalists emphasize that the scale of the financial transfers—approaching USD 600 million—raises serious questions about political protection and institutional oversight. According to expert assessments, it would be implausible for a 33-year-old accountant to execute such large-scale operations independently without external support.

Institutional Silence and Media Accountability

The fact pose pointed questions to state institutions and the media, asking why:

Intelligence and regulatory authorities did not publicly intervene,

Judicial bodies have not provided transparent and regular updates,

Major media organizations offered limited coverage,

Opposition parties failed to pursue sustained parliamentary oversight.

Experts warn that sustained institutional silence weakens democratic accountability, particularly when issues involve international sanctions compliance, cross-border finance, and strategically important energy assets.

Erdogan Exchanged Captain Marco for Oil Trader Mustafa Yiğit Zeren

Businessman Mustafa Yiğit Zeren, who conducts oil trade between India and China through the Rosnet , a company owned by the Erdogan family in Russia, was detained in Croatia.

In July 2025, Mustafa Zeren was arrested in Croatia while being sought under an Interpol Red Notice at the request of Russia. He was apprehended upon landing in Zadar on his private jet. Zeren is recognized as the businessman responsible for carrying out approximately $56 billion worth of illicit oil trade for Rosnet boss Sechin, owner of Rosnet, targeting India.

The Turkish authorities requested Zeren’s extradition, but he was released after spending one night in detention.

One-Week Process:

Following his release, Zeren stayed at a five-star hotel in Zadar. Subsequently, intense diplomatic negotiations between Ankara and Zagreb took place, during which the possibility of a “swap” with Croatian Captain Marko Bekavac, who was detained in Turkey, reportedly arose.

Who is Croatian Captain Marko Bekavac?

The matter originated in October 2023, when the Panama-flagged bulk carrier Phoenician M, commanded by Marko Bekavac, arrived at Ereğli Port. During inspection of the cargo, which came from Barranquilla, Colombia, Turkish authorities discovered 137 kilograms of cocaine hidden among the goods. The captain, first officer, and eight crew members were detained. By court ruling, Marko Bekavac was sentenced to 30 years imprisonment in Turkey for possession of cocaine.

Details of the Swap:

On 6 August 2025, under the directive of President Erdogan, two Turkish officials were dispatched to retrieve Zeren, who subsequently departed Croatia. On the evening of 8 August, Turkish authorities quietly released Captain Marko Bekavac, who had been sentenced to 30 years in prison, and on 9 August, he returned to Croatia.

The Croatian media described the incident as a “diplomatic victory,” while Bekavac highlighted the political dimensions of his experience.

Facts About Zeren:

Mustafa Yiğit Zeren, the head of Zeren Holding, was accused of failing to repay approximately $600 million to Moscow Credit Bank in Russia. The Russian bank filed a criminal complaint with the Istanbul Chief Public Prosecutor’s Office, and during arbitration proceedings, Zeren’s assets in Russia were seized. He was also sought under an Interpol Red Notice.

Circumventing the US, EU, UK, and Ukraine Embargoes:

Reports indicate that Mustafa Zeren sold Russian oil worth $56 billion, owned by Rosnet, to India via Turkey and opened a bank account in Dubai to bypass embargoes imposed by the US, UK, Ukraine, and EU. Zeren’s arrest in Croatia reportedly caused concern for the Erdogan family, as he was the businessman managing Sechin’s $56 billion Rosnet oil sales to India. To prevent information from reaching EU, UK, or US intelligence agencies, Mustafa Yigit Zeren was retrieved under Erdogan’s direct order.

It is further reported that part of the payment, approximately $600 million, was not remitted to the Russian bank.

International Dimension

Public discourse and investigative reporting indicate that international authorities and foreign partners may be examining aspects of the financial flows and sanctions-related transactions referenced in court documents. As of now, no official confirmation has been issued by foreign agencies, and these matters remain under review pending authoritative statements.

All individuals named are presumed innocent. Nevertheless, given the magnitude of the financial flows involved, the international sanctions framework, and the significant public interest implications, experts and investigative journalists underline the urgent need for:

- Independent and transparent investigations,

- Full disclosure of beneficial ownership and funding sources,

- Unrestricted and sustained media scrutiny.

Zeren Group Bank Application in Montenegro.Application Submitted & Temporary Withdrawal

The Zeren Group, a Turkish business group, first submitted an application to the Central Bank of Montenegro (CBCG) on March 15, 2024 to obtain a license to establish and operate a bank in Montenegro.

Later in September 2024, this application was temporarily withdrawn by Zeren Group. According to available reports, this was because the CBCG requested additional documentation, including consolidated financial statements prepared by one of the world’s major auditing firms.

Official Statements

The CBCG confirmed that Zeren Group withdrew the request on its own initiative before the statutory deadline for a decision. The Bank also stated that it acts in accordance with the law in all procedures for issuing operating licenses.

At the time of withdrawal, procedural discussions were ongoing with the bank regarding compliance with regulatory requirements.

In December 2024, a delegation of Zeren Group, led by Mustafa Cigit Zeren, met with the Governor of the Central Bank of Montenegro, Irena Radović.

The Turkish ambassador to Montenegro, Barış Kalkavan, was also part of the delegation.

During the meeting, Zeren expressed the intention to expand the Turkish business group’s operations into Montenegro’s banking sector, and the delegation highlighted the scale of Turkish investments in Montenegro, including Zeren Group’s €80 million contribution.

Aftermath & Repeated Applications

After the initial withdrawal, Zeren Group submitted a new request in March 2025 to establish a bank in Montenegro, continuing its investment plans.

Final Outcome

In early January 2026, the Council of the Central Bank of Montenegro rejected the application for a banking license for “Zeren Bank AD Podgorica.” The CBCG stated that the decision was made because the applicant was assessed as not meeting the legally prescribed conditions for operation.

The rejection decision was adopted by the CBCG Council in a session that included newly appointed external members, who are part of the Bank’s governance framework.

Zeren Group initially filed an application to open a bank in Montenegro in March 2024.

Due to additional documentation requests from the Central Bank of Montenegro (CBCG), they withdrew the application in September 2024.

Zeren Group resubmitted a request in March 2025, but after regulatory review and evaluation, the CBCG Council officially rejected the request in January 2026.

The CBCG’s decision was based on the determination that the application did not meet the legal criteria required to issue a banking license.

Euro Asia News – “Who Stole $600 Million From Dubai Bank?” (1 August 2024)

Leave a comment